DCV welcomes to 10 new costumers have joined their services in the months of March-April 2020.

Although debt levels have decreased slightly in recent years, the amount that each person spends per month to pay debts has increased.

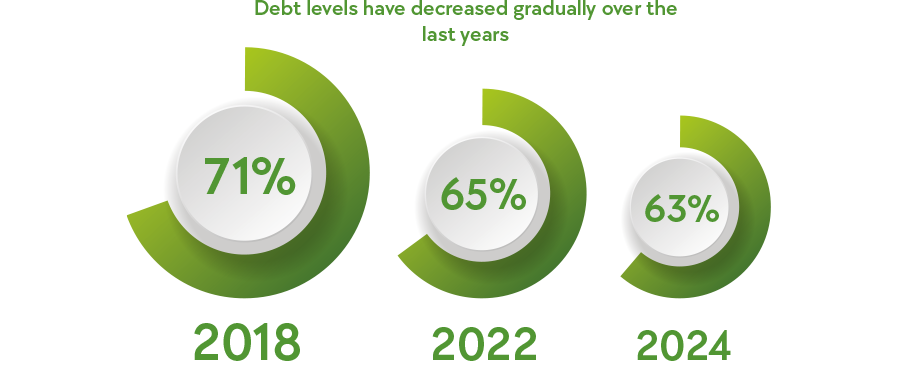

According to the results of the 4th Financial Knowledge Index published by Depósito Central de Valores (DCV) and the Center for Financial Studies (CEF) of the ESE Business School, debt levels have gradually decreased over the last few years from 71% in 2018 to 65% in 2022, and for 63% of Chileans by the end of 2024. This means that today, people spend a higher percentage of their salaries to pay their debts.

.

According to the results of the study, most Chileans use a large part of their income to pay for their loans; 61% of respondents spend between 20% to 80% of their salary each month to pay debt. It should be noted that it is recommended not to exceed 30% of income to pay debts.

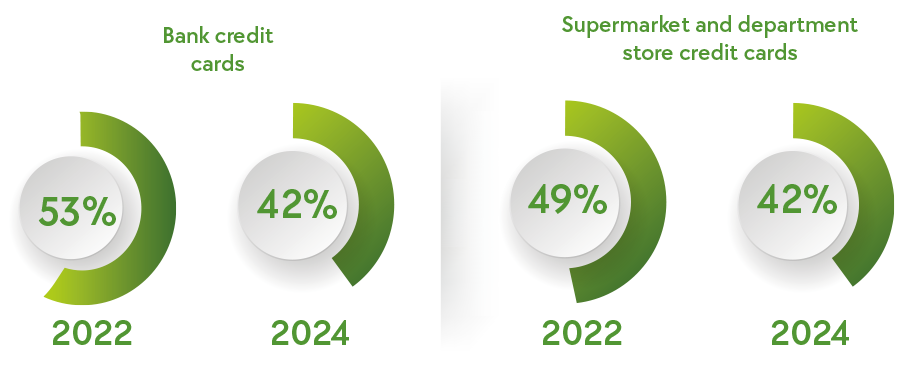

The study also shows a downward trend in the adoption of financial products. While in 2022, 53% of respondents reported having a bank credit card, in 2024, the number dropped to 48%. The same is true for department store and supermarket credit cards, which went from 49% in 2022 to 42% in 2024.

In the case of consumer loans, the percentage of people claiming to have one dropped from 30% to 25% in the same period. Mortgage loans also fell from 17% in 2022 to 14% in 2024. These trends are seen in all the different age and socioeconomic groups surveyed.

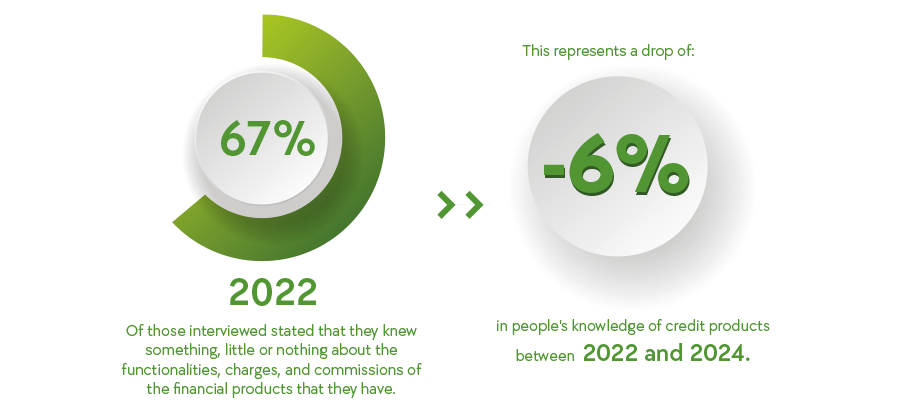

Another aspect to consider in this study is the low level of knowledge of people regarding the characteristics and operation of financial instruments linked to debt; 67% of those interviewed stated that they knew something, little or nothing about the functionalities, charges, and commissions of the financial products that they have. This represents a drop in people's knowledge of credit products of 6% between 2022 and 2024.

When asked more specifically about each product, 48% claim to know the fees they pay for their credit products; 46% say they are aware of the interest charged by bank credit cards, and 42% are aware of the interest charged by supermarket and department store credit cards. While 34% say they are informed about the interest rates of consumer loans, only 25% know about their mortgage loan.

In this context, Rodrigo Roblero, DCV's General Manager, states that "we see it as a warning sign that financial knowledge of credit instruments has decreased. The only way to reverse this scenario is through financial education. This is the main tool that allows people to manage their finances better and make informed decisions."

Misinformation and financial literacy

People have adopted social media as the new source of information for their finances; according to the results of the study, 32% of respondents claim that they obtain information to make savings and debt decisions through platforms such as YouTube, Instagram, or TikTok. This situation is more evident among young people between 18 and 35 years old, 45% of whom say they use social media to obtain information and make financial decisions.

"The previous study showed that the pandemic had improved financial literacy rates, likely due to people being forced into greater financial digitization. Unfortunately, this improvement was not sustained. The situation is concerning because, although debt levels have decreased, probably due to greater restrictions on access to credit, there is still a high level of ignorance in this area. Bad decisions in this area can greatly affect people's quality of life, which underscores the importance of financial education, which must necessarily come from public-private collaboration," says María Cecilia Cifuentes, Director of the Center for Financial Studies at ESE Business School.

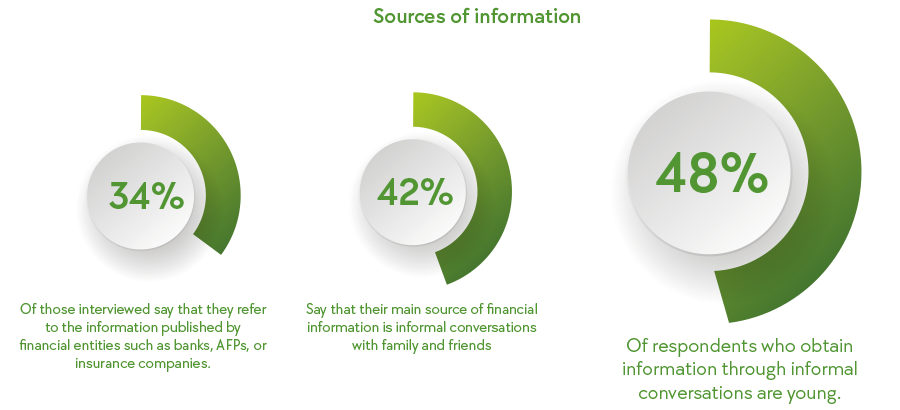

Regarding other sources of information, only 34% of those interviewed say that they refer to the information published by financial entities such as banks, AFPs, or insurance companies. In comparison, 42% say that their main source of financial information is informal conversations with family and friends. Young people are the ones who use this the most, with 48% of the mentions, which undoubtedly highlights the need to strengthen formal financial education in the new generations, with the aim of closing gaps in access to and use of financial products.

Centro de noticias

CaNew requirements are increasingly raising the standards of risk management in the financial market, and DCV joins this global trend by enhancing management and best practices.

As of February 1, 2025, the new standards 509 and 510 of the Financial Market Commission (CMF) came into force, which seek to strengthen comprehensive risk management and corporate governance in various entities of the financial sector.

DCV has worked actively to guarantee an early and efficient implementation of these regulations, ensuring compliance with the new standards and strengthening trust in the market.

Main Changes and Challenges

Standard 509 emphasizes a greater involvement of the Board of Directors in risk management, establishing a list of minimum policies and a clear structure of three lines of defense. The first line is process and service owners, the second line is risk management, and the third line is internal audits.

On the other hand, Standard 510 focuses on information security, cybersecurity, and operational incident management, incorporating strong practices, such as the NIST Cybersecurity Framework.

Both regulations broaden the scope of risk management and emphasize topics such as operational risk in corporate governance, outsourced services, and operational incident reporting. In addition, they establish roles that have to be confirmed by the Board of Directors as a counterpart with the CMF for the notification and communication of incidents.

DCV's Commitment

Since the publication of the standards, DCV has led a process of adaptation that includes review and update of internal policies in line with the new requirements, the definition of a risk framework, with key metrics for constant monitoring and approval of these changes by the Board of Directors, thus ensuring its commitment to management.

In this regard, Claudio Herrera, Risk and Compliance Manager, pointed out that "these new regulations strengthen the transparency and security of the financial market by promoting best practices, which can only lead to positive results. The fact that there are higher requirements standardizes risk management upwards and adds trust in the market".

.

Likewise, DCV has participated in the public consultation process of the FMC, contributing with observations and proposals for the improvement of the regulation.

This implies a more active role for DCV in risk supervision and alignment with international best practices. With this approach, DCV reaffirms its commitment to the safety, soundness, and modernization of the financial system, positioning itself as a robust player in the evolution of the market.

DCV News

The 30th DCV Depositors' Meeting was held on March 14. The Supervisory Committee presented a detailed report on the 2024 operational period on that day.

During the 2024-2025 period, the Supervisory Committee carried out a rigorous work plan focused on internal audit follow-up, strategic meetings with executives and external consultants, and risk and control assessment. Rodrigo Roblero, General Manager of Depósito Central de Valores (DCV), emphasized thanking this working group on behalf of the institution.

Within this framework, the high points of the 2024 management were the hiring of external auditors for audits and internal control in May 2024, as well as the collaboration with PwC and Dreamlab to strengthen security and operational continuity procedures. These initiatives made it possible to maintain reasonable control over the risks that could affect depositors, ensuring effective supervision of the company's key processes.

In terms of risk assessment and control, the results obtained reflect a high degree of compliance, with 88% of the evaluated controls executed in a timely manner and correctly documented. However, the need to update 3% of the controls in the risk matrix was identified, while 5% could not be verified due to the absence of transactions in the period analyzed.

In addition, 4% of controls were incorporated in the area of information technology, ensuring a more comprehensive coverage of operational risks. These findings reinforce the Committee's commitment to continuous improvement and transparency in the management of the company.

In broad terms, the 2024 Management Report of the Supervisory Committee evidences that DCV has been able to maintain and improve its internal control system without registering significant deficiencies and that cybersecurity measures have been successfully implemented, contributing to the stability and security of the entity's operations.

The 2025 Supervisory Committee will be composed of:

Chairman: Hugo De La Carrera Prett

Vice Chairman: Oscar Mehech Castellón

Secretary: Américo Becerra Morales

Member: Victoria Martínez Ocamica

Member: José Miguel Valdés Lira

Centro de noticias

The robustness of the securities infrastructure is essential to generate trust in the capital market. DCV has been promoting investments and exploring improvements in its operating sites system. These include the search for alternative routes to ensure connectivity and a "cold site" as part of its resilience strategy.

A fundamental pillar of DCV's work is to be at the forefront of technology. This implies an effort to manage technology and work with technological tools not only as allies but also as services that must be optimized on a permanent basis, considering the fact that systems can become obsolete quickly.

Investment in infrastructure expansion and modernization is not only a technological commitment but also a commitment to build trust in the market. The challenge is to be an entity that guarantees operational continuity, being "the last to fall and the first to recover," says Guillermo Toro, Technology and Cybersecurity Manager.

The ability to operate simultaneously and in a balanced manner at all locations is an innovation. While other players use recovery sites only in extreme cases, DCV seeks to have its customers connect to any of its data centers, thus ensuring a homogeneous and high-quality experience.

In this regard, Guillermo Toro explains that "among the challenges identified is the need to diversify the communication routes to the data centers. Alternate routes are being explored to ensure that, in the event of any eventuality, the time to reconnect and return to normal operations will be less than two hours".

Another innovative aspect is the possibility of incorporating a "cold site" in the cloud. This model implies having an infrastructure that, without being constantly active, can be quickly "unfrozen" in the event of major incidents or cyber-attacks. The implementation of a cold site would make it possible to isolate information and safeguard operational continuity without exposing all active sites to simultaneous risks.

In the event of a major outage that compromises the platforms in use, this site may be activated or "unfrozen" to ensure operational continuity.

Transparency and trust are enhanced by demonstrating that the system is designed to cope with technological crises as well as natural disasters or cyber-attacks. The integration of additional security measures and the continuous improvement in connectivity resilience strengthen DCV's operational capacity and position it solidly to face risks.

This strategy, based on high technological standards, adequate risk management, and a vision of operational continuity, demonstrates that DCV is a fundamental pillar for the development and stability of the Chilean securities market.

News Center

EN

EN  ES

ES