Although debt levels have decreased slightly in recent years, the amount that each person spends per month to pay debts has increased.

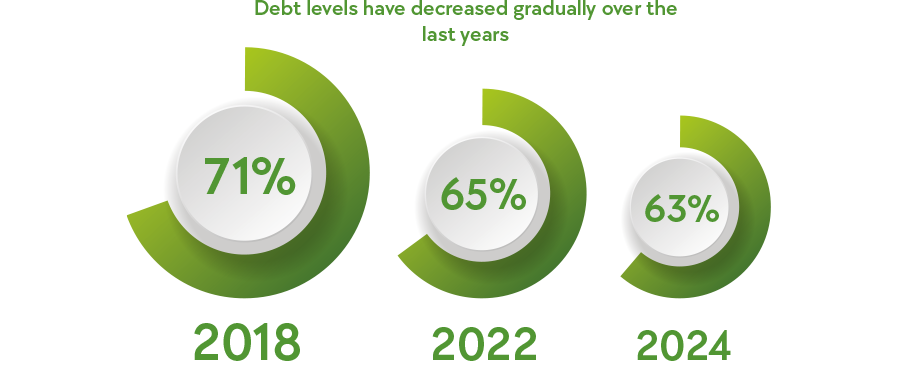

According to the results of the 4th Financial Knowledge Index published by Depósito Central de Valores (DCV) and the Center for Financial Studies (CEF) of the ESE Business School, debt levels have gradually decreased over the last few years from 71% in 2018 to 65% in 2022, and for 63% of Chileans by the end of 2024. This means that today, people spend a higher percentage of their salaries to pay their debts.

.

According to the results of the study, most Chileans use a large part of their income to pay for their loans; 61% of respondents spend between 20% to 80% of their salary each month to pay debt. It should be noted that it is recommended not to exceed 30% of income to pay debts.

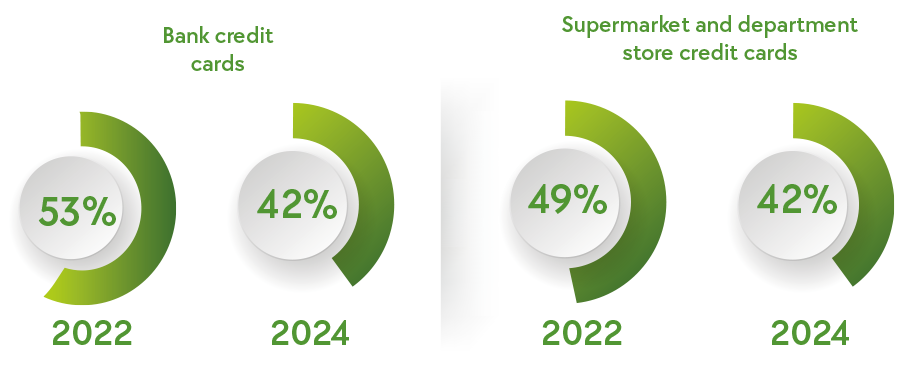

The study also shows a downward trend in the adoption of financial products. While in 2022, 53% of respondents reported having a bank credit card, in 2024, the number dropped to 48%. The same is true for department store and supermarket credit cards, which went from 49% in 2022 to 42% in 2024.

In the case of consumer loans, the percentage of people claiming to have one dropped from 30% to 25% in the same period. Mortgage loans also fell from 17% in 2022 to 14% in 2024. These trends are seen in all the different age and socioeconomic groups surveyed.

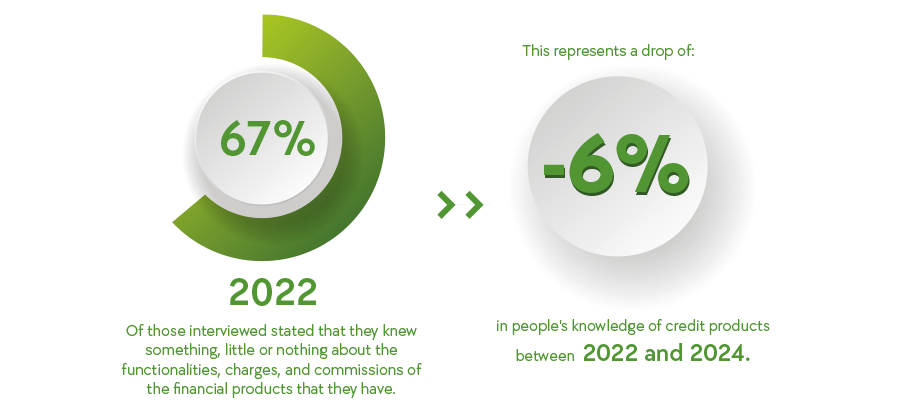

Another aspect to consider in this study is the low level of knowledge of people regarding the characteristics and operation of financial instruments linked to debt; 67% of those interviewed stated that they knew something, little or nothing about the functionalities, charges, and commissions of the financial products that they have. This represents a drop in people's knowledge of credit products of 6% between 2022 and 2024.

When asked more specifically about each product, 48% claim to know the fees they pay for their credit products; 46% say they are aware of the interest charged by bank credit cards, and 42% are aware of the interest charged by supermarket and department store credit cards. While 34% say they are informed about the interest rates of consumer loans, only 25% know about their mortgage loan.

In this context, Rodrigo Roblero, DCV's General Manager, states that "we see it as a warning sign that financial knowledge of credit instruments has decreased. The only way to reverse this scenario is through financial education. This is the main tool that allows people to manage their finances better and make informed decisions."

Misinformation and financial literacy

People have adopted social media as the new source of information for their finances; according to the results of the study, 32% of respondents claim that they obtain information to make savings and debt decisions through platforms such as YouTube, Instagram, or TikTok. This situation is more evident among young people between 18 and 35 years old, 45% of whom say they use social media to obtain information and make financial decisions.

"The previous study showed that the pandemic had improved financial literacy rates, likely due to people being forced into greater financial digitization. Unfortunately, this improvement was not sustained. The situation is concerning because, although debt levels have decreased, probably due to greater restrictions on access to credit, there is still a high level of ignorance in this area. Bad decisions in this area can greatly affect people's quality of life, which underscores the importance of financial education, which must necessarily come from public-private collaboration," says María Cecilia Cifuentes, Director of the Center for Financial Studies at ESE Business School.

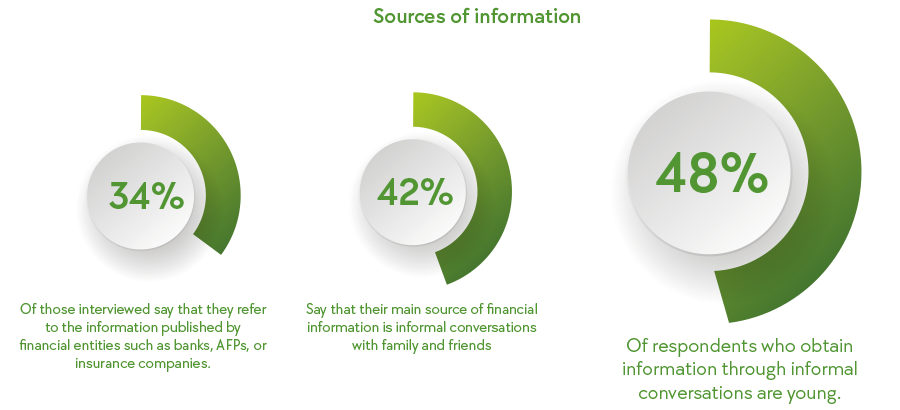

Regarding other sources of information, only 34% of those interviewed say that they refer to the information published by financial entities such as banks, AFPs, or insurance companies. In comparison, 42% say that their main source of financial information is informal conversations with family and friends. Young people are the ones who use this the most, with 48% of the mentions, which undoubtedly highlights the need to strengthen formal financial education in the new generations, with the aim of closing gaps in access to and use of financial products.

Centro de noticias

EN

EN  ES

ES