According to the study conducted by the Depósito Central de Valores (DCV) and Centro de Estudios Financieros, ESE Business School, 55% of respondents state having a low level of financial knowledge, which represents a deterioration with respect to this same index in 2022.

Depósito Central de Valores (DCV) and the Centro de Estudios Financieros, ESE Business School, presented the results of the fourth version of the Financial Knowledge Index, which revealed a generalized drop in the level of knowledge about financial matters in Chile. According to the report, which is conducted every two years, 55% of respondents report having a low level of financial literacy, an increase of 13 percentage points from 2022. Only 16% report a high level of knowledge, a decrease of 5 points compared to the previous study.

The study, commissioned to Cadem, was based on 1,017 interviews conducted between September and October 2024 and aims to provide an overview of the use and knowledge that Chileans have of the different institutions and products in the financial market, thus contributing to the conversation and public debate on financial inclusion and education in the country.

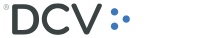

Among the main findings, there are significant gaps between the different population groups. The numbers indicate that people belonging to the lower income segments (D/E) are those with the greatest lack of knowledge (82%). On the other hand, men report a higher knowledge index (20%) and higher than women (11%), regardless of the socioeconomic sector.

In this regard, Rodrigo Roblero Arriagada DCV's General Manager pointed out that, although this year's results show a generalized worsening, they are key to promoting public policies that encourage greater financial education. "This study reaffirms the challenge we have as a society to improve financial education. Knowledge about financial institutions and products is essential for people to make informed decisions and build a solid foundation for their economic future."

Likewise, the report details that the general knowledge about all existing financial institutions in the country dropped from 82% in 2022 to 73% this year.

Ownership of products and means of payment

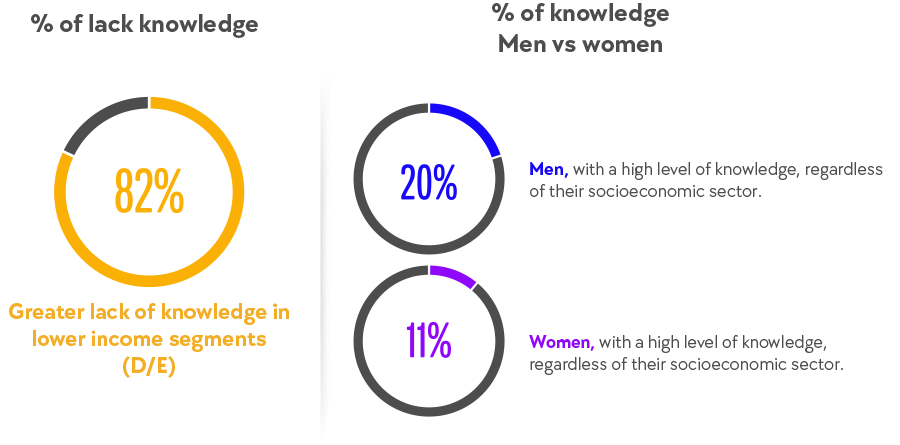

Debit cards and sight accounts or "cuenta Rut" (a sight account issued only by BancoEstado for citizens with an ID number) continue to be the financial products most used by Chileans, with rates of 81% and 89%, respectively. In third place are online payment applications which have emerged as an option in recent years, with a 64% adoption rate, surpassing for the first time other traditional means such as current accounts or credit cards.

Although 48% say they are holders of a bank credit card, 39% of respondents claim they know little or nothing about the characteristics, charges, or commissions they pay for such cards. In turn, 14% stated that they have a mortgage loan, which shows a low penetration of this product in Chilean households in recent times, but, in addition, 54% of those who have a mortgage say that they know little or nothing about the conditions of their loan.

Socioeconomic and technological gaps

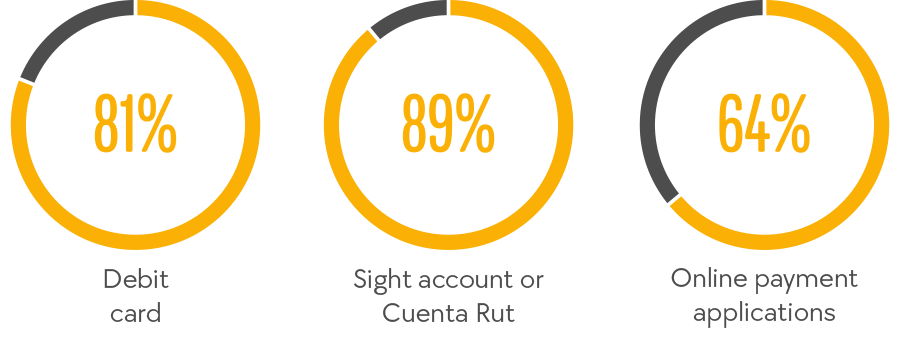

The possession of financial means reflects differences between segments of the population. For example, the use of online payment applications reaches 83% in the highest income segments (C1) but drops to 41% in the D/E segment. Likewise, 18-34 year olds lead the way in financial technology adoption, with 74% using payment applications, compared to 43% for those 55 and older.

Cecilia Cifuentes, executive director of the Centro de Estudios Financieros, ESE Business School, points out that "the digitalization of means of payment represents an opportunity to improve access to financial products, but it must be accompanied by efforts to close the knowledge gaps that especially affect the most vulnerable sectors."

Since 2018, the holding of financial products and the use of means of payment have evolved in line with global trends, such as the consolidation of digital media. However, the report shows that more complex products, such as mutual fund investments (24%) or life insurance with savings (35%), remain largely unknown to the majority of the population.

Download full report

News Center

EN

EN  ES

ES