|

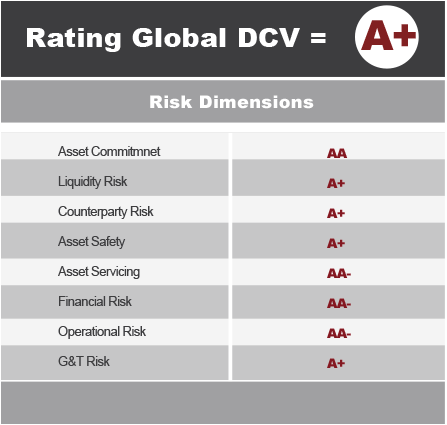

The global risk evaluation performed this year by the company Thomas Murray has positioned DCV at a low risk level by obtaining the A+ classification, above the risk average of depositories in America and exceeded only by Brazil within Latin America, and Canada and the United States in North America.

The measurement considered six risk dimensions and in this opportunity, two new dimensions have been added: Asset Commitment Risk and Governance and Transparency Risk (G&T Risk). “Asset Commitment Risk” considers the risk associated with the time that the securities or money is withheld until being received by the counterparty. In turn, “Governance and Transparency Risk (G&T Risk)” reflects the risk of a participant incurring a loss as a result of DCV not acting in accordance with the laws or regulations, or that it fails to provide complete or accurate information of its activities or the securities market activities.

These two new evaluations have affected the global results of the Company, so maintaining the A+ qualification obtained in 2011 signifies significant advances for DCV.

The evaluation considers a global review of DCV processes, projects and environment, including regulators and participants who, through interviews, provide information for the global assessment.

This review shows some strong points that clients see in DCV, as the way they perceive DCV management team as having solid knowledge and experience in conducting the business. Similarly, the fact that DCV is a highly audited company internally and externally, in addition to the Surveillance Committee – where participants are involved – is also seen as something positive.

In turn, Thomas Murray highlighted the separation of the responsibility of the risk and audit areas, as it constitutes progress in terms of good international practices and an improvement in the efficiency of the areas. The solid risk management policies, including critical and non-critical processes, also represent a positive point.

Looking to clients, the organization of users’ committees where clients of different types have the opportunity to express opinions in relation to the service and their requirements.

Also, the complete and pioneering disaster recovery plan that includes two processing centers separated by no less than 11 kilometers and a third one outside Chile.

However, improvement areas have been detected also, where DCV assumes total commitment to continuous evolution and improvement. Among these areas, aspects are mentioned related to the blocking of securities for many hours during the day in OTC operations, or for short periods in stock market transactions, limiting participants’ liquidity. This point has special validity from this measurement, as it wasn’t previously considered as a risk dimension. Today it is starting to be observed with the incorporation of the “Asset Commitment Risk”. Also mentioned is the limitation of not having liquidity facilities for international transactions where participants must have funds in their accounts one day prior to the settlement, a situation that DCV is looking into in order to find a solution for clients of the International Custody Service. The fact that DCV does not communicate totally via Swift messaging, reducing clients face-to-face STP (Straight Through Processing) is internationally seen as a weakness.

There are also the aspects related to the current legislation, which demands the existence of mainly manual processes in DCV Registros, or the management of physical documents in various processes related to corporate events, which does not allow automation of all the processes.

With regard to the continuity plans, it is required to go even further and consider situations for alternative work offices for a prolonged period of time, for example, six months, situation, which is not addressed by the current existing plans.

Finally, it is pointed out that DCV systems are old, complex and costly to maintain, however, the effort and work that DCV is undertaking in this connection through its DCV Evolution project is acknowledged; the results of this work will not be reflected in the evaluation until it is completely finished.

Some of the weaknesses are, undoubtedly, related to the current regulation and other aspects in which DCV is working. All of them represent a challenge and commitment to continue progressing in the application of best international practices.

DCV Noticias |

EN

EN  ES

ES