This economic sector is quite positive in terms of the evolution of its companies.

However, the economic expectations for the country are not as optimistic.

To get to know more about the economic point of view of the Fintech industry, Depósito Central de Valores (DCV), Diario Financiero, FinteChile, and EY Chile created a partnership to conduct the Fintech Expectations Survey, where relevant information about its characteristics, business expectations and their view on the country’s economy was collected.

The sector is becoming more relevant and is also contributing to the inclusion of traditionally left out segments that could not access the traditional financial industry systems. This survey becomes of particular interest to obtain more information on how these companies have handled the pandemic, the forecasts for their businesses, and their main challenges and opportunities. In addition, a particular focus was placed on the recent delivery of the Fintech bill of law from the Executive.

Main Results

After surveying Fintechs on the current situation of their businesses, 84% answered that it is “Very good” or “Good,” and only 9% indicated that their sales had decreased over the last year; 94% expect for them to grow in the following 12 months. In the same line, 96% expect to hire talent, and 74% plan to make capital investments. When asked about how the sector would come out of the pandemic, the answers are inclined towards growth, more regulations, and an increase in profit.

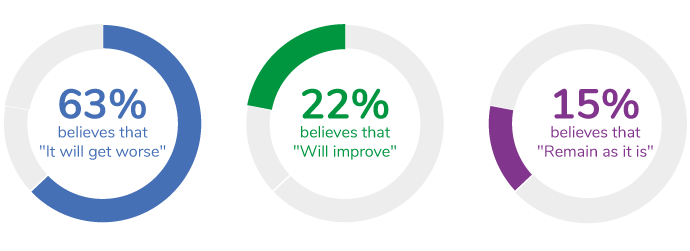

The above does not match the answers provided on the evolution of the Chilean market. 63% believe that it will “worsen” and 15% that it will “remain as it is,” whereas only 22% think that it will “improve.”

What is the forecast for the Chilean economy?

“In this third version of the survey, we see once again that the expectations from Fintechs are very positive. However, there is a contrast when asked about the country’s economy. The above is starting to become a trend and a reflection of the expansion and the view that this energetic industry has.”

Javier Jara Traub, DCV Legal and Corporate Affairs Manager.

Regarding the bill currently being discussed in Congress that intends to regulate the sector, the vast majority (87%) has a good opinion. However, there are several views on the regulatory burden that it proposes: 48% considers it as “high” or “very high,” the same percentage as “appropriate,” and only 4% as “low.”

"The positive results and expectations for Fintech companies in Chile are yet another cause for public policies to accompany their growth and consolidation to achieve greater innovation and financial inclusion. At this moment, the ball is on the Congress’ side with the Fintech Law and the Consolidated Debt Law, which is why we expect for these bills to be prioritized and be passed as soon as possible."

Ángel Sierra, Executive Director of FinteChile.

On the other hand, financing through hedge funding represents the last step in this industry’s maturity. It is one of the three most relevant challenges of the sector, together with regulatory uncertainty, recruiting, and talent retention, that is on top of the list. “For years now, investing was something that only a few audacious people did in an unknown industry, whereas now it is seen as a way to create partnerships or to grow those Fintechs. There is no doubt that in the success of several Startups and Fintechs, Insurtech has provided a greater level of trust for other players to become part of the industry and hopefully to have more Corporate Venture Capital,” said Mauricio Martínez, EY Financial Services Technology partner.

About their Characterization:

The surveyed Fintech companies are highly centered in the Metropolitan Region (96%) and the “Banking, Payment, and Transfers,” “Crowdfunding & Lending,” and “Financial Management” sectors.

72% of the surveyed firms have between 0 and 50 and only 6% more than 200. As per their annual sales, 30% invoice more than 50,000 UF and 24% below 2,500 UF.

The highest range of seniority is within two years old (22%), while 17% is ten years old or more.

Regarding their participation in property, it is mostly from founding partners followed by non-founding partners. 43% have participated in investment round tables, and approximately half only operate in Chile (52%), where Peru has 33% of the preferences, and it is the second country where local Fintechs have expanded.

The survey took place between October and November of this year, and it comprised 54 Fintech companies.

Revisa el estudio completo (PDF)

EN

EN  ES

ES