Securities depositories appeared in the world markets as a way to facilitate the custody and settlement of securities operations. at the local level, DCV was incorporated in accordance with a specific law that regulates and oversees its work, where its owners are its main clients: issuers, intermediaries and institutional investors.

On March 15th, 1993, the Depósito Central de Valores (DCV) was born. It is a sociedad anónima that was incorporated in accordance with Law 18,876 of 1989, and its respective regulations, and the instructions issued by the Commission for the Financial Market. This same law established its exclusive purpose, that is, receiving securities on deposit and facilitating the transfer operations between depositors. The above in accordance with the procedures contemplated in the aforementioned law, through charge mechanisms and the payment of position accounts that DCV's clients maintain in the company.

Securities depositories arose worldwide as a way to facilitate the custody and settlement of public offering securities operations made in the securities market. By the 80's, the reality of the financial and securities market made it necessary to present a solution to a series of problems derived from its growing activity and the consequent flow of both securities and financial operations, which did not have an agile and secure response in the prevailing settlement and clearing system.

The new system had to reduce the risks associated with the physical management, transfer and transport of the securities, as well as guaranteeing the security of the portfolio of instruments maintained by each depositor, avoiding the repeated authenticity verification of the traded instruments. Similarly, preparing and delivering payments, reducing the costs and operational complexity of the custody administration function, and perfecting and facilitating transactions between buyers and sellers, giving them information on the existence of funds necessary to carry out transactions, as well as the existence of committed securities.

Since its initiation - 1993-, 27 years have passed where DCV has fulfilled its purpose and has played a key role in the operation of the Chilean securities market, granting security, transparency and quality in the service. Today, DCV serves 186 direct clients (depositors) and more than 1,800 operators interact daily with the service platform.

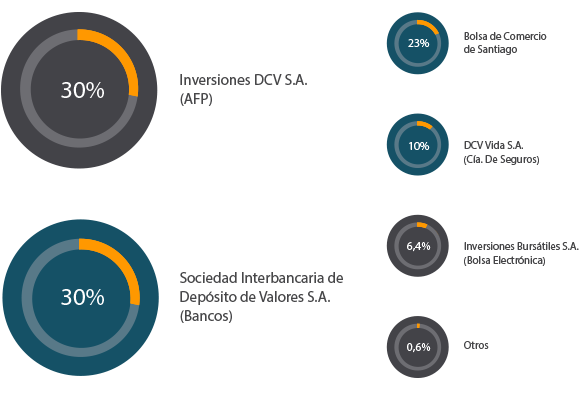

But who are the owners of DCV? Some of their clients, that is, issuers, intermediaries and institutional investors that operate on a daily basis in the market. Banks and AFPs each maintain 30% of the ownership of DCV; life insurance companies have 10%; the Santiago Stock Exchange 23%, the Chilean Electronic Exchange 6.4% and, finally, other minority shareholders 0.6%.

News Center

EN

EN  ES

ES