All the general managers of the trade associations from the financial sector and stock exchange managers attended the meeting.

The Depósito Central de Valores and the Center for Financial Studies of the ESE Business School of Universidad de los Andes summoned the principal representatives of the financial world to create a financial education work meeting, whose objective is to have an instance capable of articulating a joint view of this sector around good practices, developments, progress and challenges around this key development issue.

The idea is part of a strategic alliance between the two institutions that seeks to deepen the work that both entities carry out individually to lead it to specific works and projects that will directly benefit the strengthening of the Chilean capital market and its users.

In recent times the interest of citizens in public affairs (that have an impact on their daily lives) has increased. From this growing interest in different topics, the financial world has not been an exception. According to a study on financial education prepared by DCV and ESE, all financial institutions have increased their level of knowledge. Along these lines, almost half of those surveyed and, according to those options that lead the preferences, it was shown that they would like to learn and know more about investments (mutual funds, stocks, APV, etc.), and a third indicated that they would like to know more about the associated risks to these types of instruments.

This issue is becoming increasingly relevant considering that as of July and, according to data from the Central Bank, total household debt (calculated as a percentage of annual disposable income) remained at historical levels, reaching 75.4%.

The first meeting was held on October 29th and was chaired by Fernando Yáñez and Javier Jara Traub, Legal and Corporate Affairs Manager of DCV, and Cecilia Cifuentes and Santiago Truffa, professors at ESE. Additionally, the following persons participated: Pilar Concha, General Manager of ACAFI; Mónica Cavallini, General Manager of the Mutual Fund Association; Carmen Gloria Silva, Deputy Planning Manager of the Banks Association; Fernando Larraín, General Manager and Isabel Retamal, Development Manager, both from the AFP Association and José Antonio Martínez, General Manager of the Stock Exchange. Jorge Claude, General Manager of the Association of Insurers and Juan Carlos Spencer, General Manager of the Electronic Exchange, participated in the initiative, although they could not participate in the meeting.

The attendees committed to a common roadmap to seek developments and initiatives that increase the knowledge of users of the financial system.

News Center

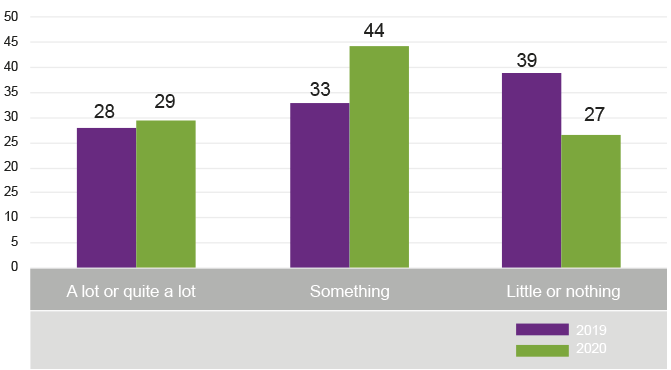

The survey details that 7 out of 10 chileans know something, little or nothing about financial issues.

The Depósito Central de Valores (DCV) together with the Center for Financial Studies of the ESE Business School of Universidad de los Andes carried out the second version of the financial education study. The survey, carried out by Cadem, allows the building of a Financial Knowledge Index that shows progress compared to 2018, especially in relation to the products and institutions of the system. However, the general knowledge level of the market and its understanding is still low.

The initiative is part of a strategic alliance between the two institutions that seeks to deepen the work that both entities carry out individually to lead it to specific works and projects that will directly benefit the strengthening of the Chilean capital market and its users.

Generally speaking, how much do you know about financial matters? (%)

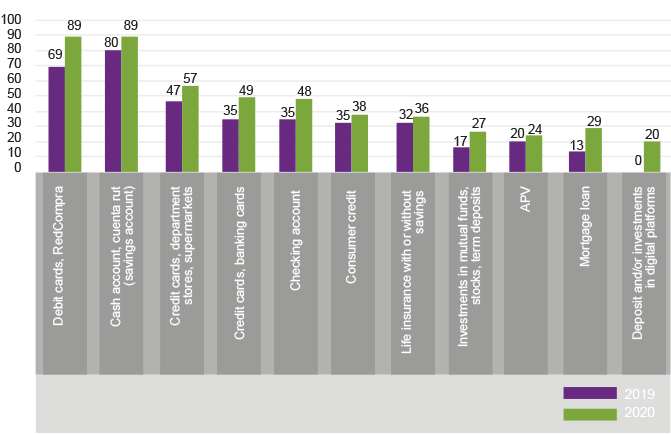

What financial products, do you currently have possession of ...? (% Yes)

“We see a growing level of knowledge on the characteristics and functions of financial products, and also about specific aspects of personal finance. Undoubtedly, the withdrawal of 10% from the retirement funds has contributed to this regard. Thus, an improvement is observed in the Financial Knowledge Index (which is constructed with the different variables of the survey), which went from reporting a high financial knowledge of 16% in 2018 to 29% in 2020”, comments Javier Jara Traub, Legal and Corporate Affairs Manager of DCV. He adds that this increase is reflected mainly in men (from 19% to 37% in two years), people aged 55 and over (from 17% to 41%). “However, the knowledge gaps between women and men, age and socioeconomic groups are worrying”, warns Jara.

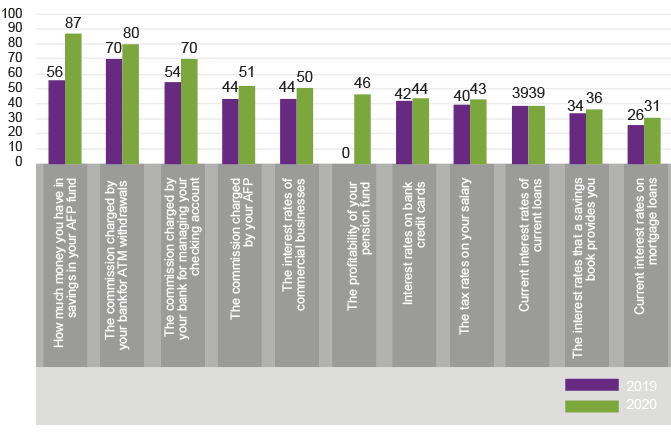

In general, do you know or know about ...? (% Yes)

This year metrics were incorporated to evaluate the degree of sophistication of clients, to know if they understand in one way or another what interest rates, inflation and investment risks are. This exercise shows that there are significant gaps by age, gender, and socioeconomic group.

When asked about what they would like to know more about, the answers are mostly inclined towards information about investments, such as mutual funds, stocks, term deposits, etc. However, regarding these types of instruments they possess them to a lesser extent: only 27% say they have investments in mutual funds, stocks, or term deposits.

Review the second full study

Revisa el segundo estudio completo AQUÍ

News Center

Claudio Garín, operations and services manager, explains how the Depósito Central de Valores (DCV) has managed these months of remote work maintaining its quality standard.

What measures has DCV taken towards clients to ensure that the quality of the service is not altered despite remote work?

The impossibility of maintaining face-to-face customer service for our physical custody services (Vault) and in our affiliate DCV Registros challenged us to implement electronic operation protocols that allow operational continuity without our processes being affected by risk. This required registrations and reconciliations (232 participants). At the end of September, 100% of the adhered clients confirmed their validation of the processed transactions totaling 7,821.

Internally, how have you managed to stay communicated and coordinated as a team?

The collaborators of DCV and DCV Registros have maintained communication through the usual channels (telephone and email), which included the Microsoft Teams application and connection to the Company’s systems via VPN and VDI.

In turn, virtual meetings have been defined for control of operations and general coordination.

How do you rate the operation of DCV during these months?

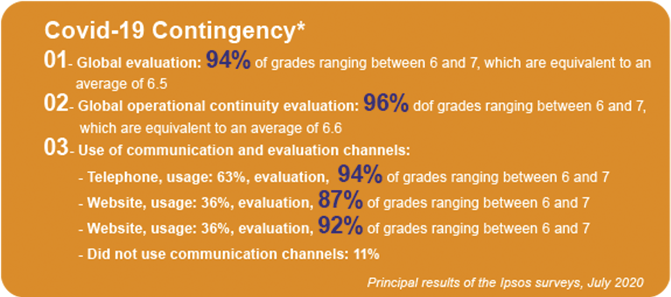

We are very satisfied with the operation during this period of Pandemic. In turn, the quality of service surveys that we have carried out again (as of July) support this.

How has communication with clients changed during this period?

Our service channels (MAC) and (MAC ARA) by phone and/or email have been available from the first day of remote work, and they have been transparent for our clients.

What are the great lessons to be learned from these critical moments?

"Companies like DCV, which are critical to the capital market infraestructure, have lived up the demands. Analyzing both the technological, operational, and service issues, we can conclude that our adaptation and continuity cabilities have met expectations".

Claudio Garín

Operations and Services Manager

Our collaborators have adapted to the telework needs and flexibility that was required and, although the continuity of critical personnel was always present in our BIA (business impact analysis) work, in the face of the pandemic we were challenged to switch the entire company to remote work (successfully).

News Center

More than 3,000 trainees of a total of 67 companies participated in the study carried out by firstjob.

The Depósito Central de Valores (DCV) held the sixth position at the national level among more than 67 companies in the third version of the Best Companies for Trainees ranking carried out by Firstjob, the largest platform for students and young professionals in Latin America.

The ranking considers the learning and knowledge acquired, the possibility of continuing in the company, global experience, perception of leadership and remuneration.

“This is a recognition that fills us with pride because it means that our corporate culture, which includes excellence, but also human quality, touches all who come to this institution. Additionally, having young people enthusiastic on developing professionally here is a good sign for us as a company”, commented Fernando Yáñez, General Manager of DCV.

“This award reflects how professional experience can be virtuously linked to an activity that generates value for both employees and the company. We are very happy, because it is also an award that somehow belongs to everyone at DCV, since many areas year after year receive trainees, which means that we are a welcoming company”,

Sandra Valenzuela, Human Resources Manager of DCV.

DCV receives annually between 13 and 16 trainees who carry out their professional fieldwork in different areas of the company

Check the award

News Center

EN

EN  ES

ES