""DCV is the gateway to the Chilean market that allows us to offer a range of services for local certificates to international financial entities."

At the beginning of 2011, Depósito Central de Valores (DCV) looked beyond its national borders and embarked upon a process to analyze and develop services for the international market. To start this journey, DCV looked for agreements to exchange services with foreign securities depositories, and it established a partnership with Euroclear, one of the world's leading financial securities clearing and settlement services.

This partnership has been in place for 11 years. It has improved Chilean investors' access to international markets and vice-versa, facilitating the Chilean sovereign bonds settlement process with international investors that are part of Euroclear.

"Our partnership with DCV has been successful." We are interested in continuing to develop strategic relations with the Chilean market because the relationship with DCV provided its depositors access to international markets," said Diego Pizzamiglio, who addressed the benefits of the agreement and the importance that it has for foreign investors to be able to invest in our country.

1. What opportunities does Euroclear see in Chile that makes it interesting to have a strategic partnership with DCV?

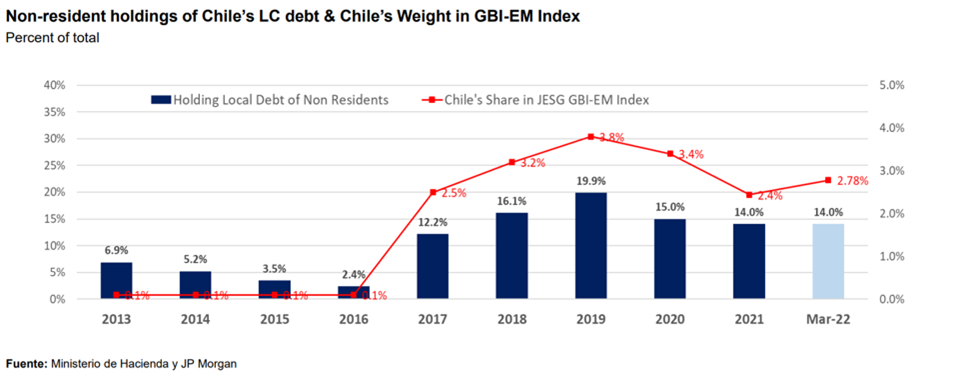

The first conversations we had with the Chilean market were with the Ministry of Finance, which approached Euroclear to increase and diversify the investment base to create a "yield curve" of its bonds. The Ministry's objective was to increase the importance of Chile as a sovereign issuer in global indexes, such as the JP Morgan Bond, which allows easy access to local debt instruments. The link was established in 2016, and the importance of Chile in JP Morgan increased substantially, as described in this chart:

Euroclear Bank holds certificates, has a high credit rating and offers its clients extended protection of their assets held in custody.

Due to this, we decided to open a direct account with DCV for our international clients to settle their transactions in Chilean bonds in our books and offer cross-border settlement services.

2. What is the importance of this agreement between DCV and Euroclear Bank?

It guarantees mutual access to the services of both entities. For Euroclear, DCV is the gateway to the Chilean market, allowing us to offer a range of services on local certificates to international financial entities. That is why we are ensuring that local issuers (private and banking institutions) can benefit from our link to diversify their investors' base for the instruments issued locally in Chile.

3. What benefits does Euroclear provide to DCV's clients/depositors?

This partnership allows depositors to extend their existing business relations and settle transactions in Chilean bonds with international counterparts. Similarly, DCV offers its clients the ability to diversify their investment portfolio to more than 50 markets through safe access.

4. What challenges do you see in the development of investments between Euroclear and the Chilean capital market?

The first phase of the link was very successful, with an evident increase in the holdings we hold in custody. International financial entities can use Euroclear's account to access several markets directly because the aim is to extend the range of eligible certificates. Since 2021, Chilean corporate debt has been eligible for Euroclear. We work with the Chilean Securities Depository to inform local issuers and their law firms about these new business opportunities, positioning the advantages of accepting corporate bonds as "Euroclearable" instruments.

In addition, we are analyzing the possibility of accepting other local instruments, such as Chilean investment funds, if our clients express a clear interest.

5. In the current world context, what is the business's role in promoting Chilean and foreign investments and industries?

The Euroclear group manages 38 trillion euros in assets held in custody. In 2021, our clients entered approximately one quadrillion transactions in our system, connecting issuers and global investors. Most international financial entities (banks and brokers) have direct accounts in our books. This reality allows Chilean local issuers to benefit from a base of very important potential investors to increase the liquidity of instruments. Due to this, our clients are always looking for new collateral sources to diversify their investments; they use Chilean certificates as a guaranty of their financial transactions (repos, certificate loans, derivatives).

The fact that Chile is the economy with the highest rating in Latin America makes considering domestic bonds an eligible collateral and further increases their liquidity. Also, one of our strategic goals is to maintain and ensure the stability of financial markets and reinforce our involvement in a more sustainable financial world, creating interconnections between issuers and investors to facilitate the growth of ESG services.

6. How would you qualify Euroclear's experience with DCV since the early days of this partnership?

From the beginning, I had the opportunity to be involved in the conversations with the Ministry of Finance and Depósito Central de Valores to establish the link with the Chilean market. It was a very fulfilling stage. The characteristics of DCV's services and those of the Chilean market's local infrastructure met our requirements to consider Chile an eligible market in Euroclear. They were key to the success of this initiative.

News Center

EN

EN  ES

ES