JAVIER JARA TRAUB, LEGAL AND CORPORATE AFFAIRS

MANAGER OF THE DEPÓSITO CENTRAL DE VALORES (DCV) PARTICIPATED IN THE “NEW

BUSINESS MODELS AND THEIR IMPACT ON THE FINANCIAL COMMUNITY” WEBINAR.

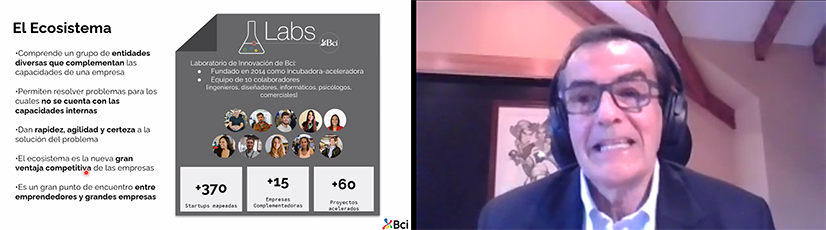

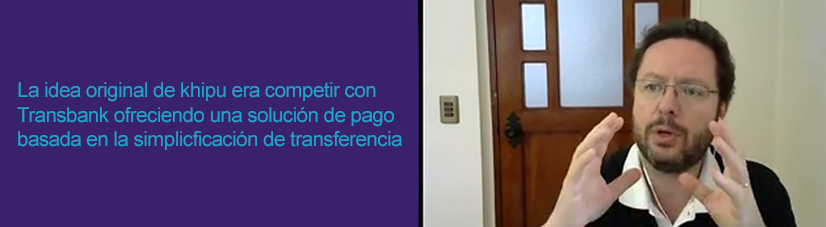

The webinar, to which close to 160 people attended, had the participation of Javier Jara Traub, Legal and Corporate Affairs Manager of DCV; Kevin Cowan, Commissioner of the Commission for the Financial Market (CMF); Hernán Orellana, Director of Banco BCI and Roberto Opazo, founding partner and Executive Director of the Fintech company Khipu.

“New business models and their impact on the financial community” was jointly organized by the Centro de Estudios Financieros y el Centro de Innovación y Emprendimiento del ESE Business School of the Universidad de los Andes.

In the webinar the technological changes that have taken place in the financial system in recent years were addressed and, additionally, how the current pandemic situation has driven these changes with greater speed. This new reality has been translated into new business, operations, and customer service models.

During his presentation, Jara explained that DCV is working in two areas to face the changes that the financial system is currently experiencing. On the one hand, developing technologies that allow improving current businesses and their natural evolution and, secondly, being active in the face of technological changes that may modify DCV’s current service and business models.

In this way, the company is modernizing the “core” of its business through an alliance with Nasdaq, which will allow it to have a system that will respond in an agile way to future challenges, incorporating the best international practices and favoring security of transactions and efficiency in operational management.

Additionally, the company has a Fintech Observatory where different initiatives with Blockchain technology are developed and where there are joint works with the Central Bank, the Stock Exchange, and GTD.

For his part, regulator Kevin Cowan gave an overview of the state of Fintech today in Chile, its growth and emphasis, noting that it relates mostly to payment and remittance operations companies. The commissioner added that they have observed how this sector is supporting traditional financial companies, either substituting or supplementing their value offering. In this context, he noted that the CMF is working on expanding and making the regulatory perimeter more flexible to incorporate these types of companies under its supervision and regulation.

Hernán Orellana, Director of Banco BCI and Roberto Opazo, founding partner and Executive Director of the Fintech company Khipu announced different initiatives that they are developing in the companies where they participate.

You can review the full seminar here

You can review the full seminar here

Center news

EN

EN  ES

ES