|

|---|

|

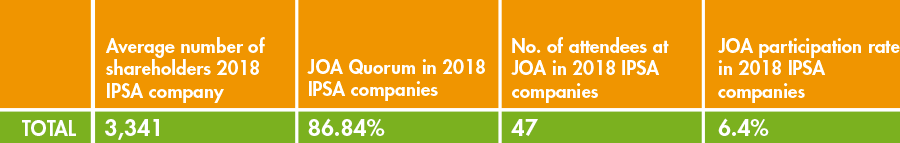

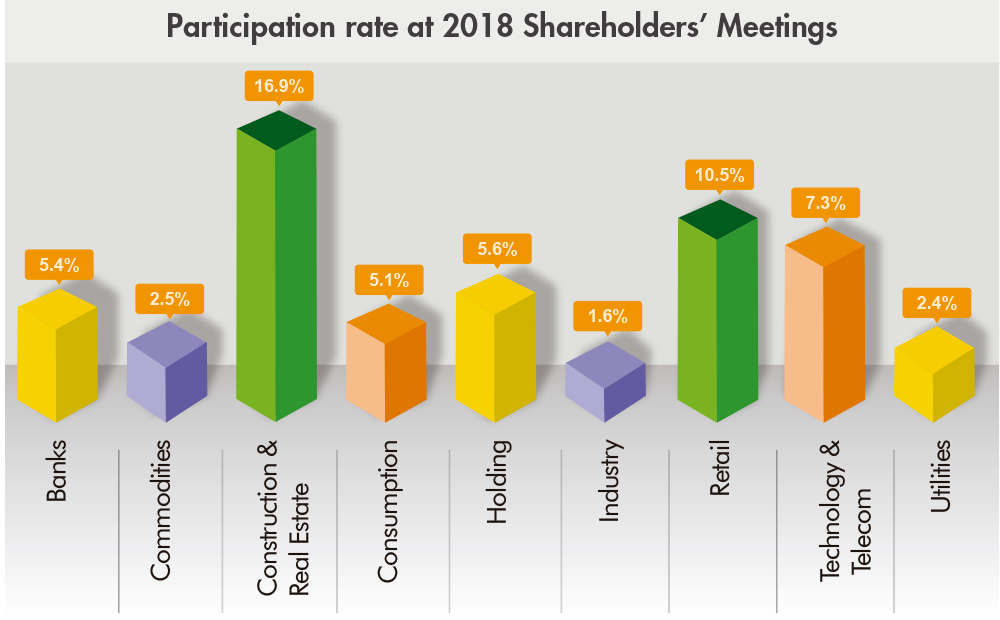

INTRODUCTION During the first quarter of this year, local sociedades anónimas held their ordinary shareholders’ meetings, where the administration informs investors of the company’s current operations and future plans, financial statements are approved and, in some cases, the board, the external auditor and the risk rating agency are renewed, among other matters. The following report analyzes shareholders’ participation in these meetings. To this end, a sample of the companies that are part of the Índice de Precio Selectivo de Acciones (IPSA), and whose shareholders’ registry is kept by DCV Registros, a subsidiary of Depósito Central de Valores (DCV), was taken. These are 25 of the 40 companies that make up the index, which have a relative weight of 52.18%. N° OF SHAREHOLDERS Regarding the number of shareholders of the companies, the sample is very diverse: from companies with less than 300 to those with more than 23,000. On average, the total number of shareholders of the companies in the sample is 3,341 individuals or legal entities (this figure includes stock brokers, international custodian banks, among other institutions that represent other investors). QUORUM Quorum is the number of shares represented at the shareholders’ meeting, compared to the total shares issued by the company. Claudio Garín, DCV’s operations and services manager, explains that due to the ownership structure of most of the local sociedades anónimas abiertas, a small number of investors hold a significant number of a company’s shares. Thus, in most cases, quorum represents more than 80% of the ownership. During 2018, IPSA companies in the sample had an average quorum of 86.84%. ATTENDANCE DURING 2018 On average, 47 shareholders or representatives thereof attended shareholders’ meetings held in 2018, equivalent to a participation rate of 6.4% (compared to the total number of shareholders). Claudio Garín explains that 2 companies in the sample had a participation rate above 20%, whereas 7 companies were below 1%. He also added that, by sector, the highest ones are in Construction and Real Estate (16.9%) and Retail (10.5%). SUMMARY OF SHAREHOLDERS’ MEETINGS (JOA)

|

EN

EN  ES

ES