|

Today, MILA is the first market in Latin America both in the number of companies listed and the size of market capitalization. It has more than 700 issuers whose shares are automatically eligible for trading in any of the MILA countries. In the past five years, MILA has positioned itself as the largest market in the region, both in the number of issuers and in market capitalization. This positioning is acknowledged worldwide. Un poco de historia: El nacimiento del mayor mercado de Latinoamérica The Latin American Integrated Market (MILA) was born in 2011 after the agreement subscribed between the Santiago Stock Exchange, the Colombian Stock Exchange and Lima Stock Exchange, as well as the depositories DECEVAL, DCV and CAVALI, which since 2009 devoted themselves to the creation of a regional market for the trading of equity securities. After several months of joint work with the participation of the principal actors of the three markets and governments of each country, on May 30, 2011, MILA began operating, opening a world of opportunities to investors and intermediaries from Chile, Colombia and Peru. MILA’s implementation meant opening the possibility of buying and selling equity instruments from the three stock markets simply through a local intermediary. In this way, MILA was created with the purpose of becoming a significant investment pole in the region, offering issuers, intermediaries and investors attractive opportunities to access the market. Its mission is to promote the growth of the trading activity of the member countries, offering an efficient and competitive infrastructure, a better and higher exposition of their markets, and supply of products and opportunities for local and foreign investors.

Furthermore, its purpose is to promote the growth of financial businesses for participants, offering a better alternative for investment, diversification and financing through a complete infrastructure that generates added value for its participants and carrying out a joint effort with the countries’ governments which maximizes the advantages of the integration. In June 2013, in the context of the Pacific Alliance, the Mexican Stock Exchange and the Mexican Securities Depository, INDEVAL, made their incorporation to MILA official, the first trade with this market been performed on December 2, 2014. The integration of the Mexican Stock Exchange by the end of 2014 allowed the consolidation of MILA, strengthening its position as integrated financial market at a regional level. Mexico itself is a market with significant development, attractive products and with a strong investment in foreign securities market instruments. MILA, the financial arm of the Pacific Alliance MILA is the first transactional trading integration initiative without a global merger or corporate integration through the use of technological tools and the adaptation and harmonization of the regulation on capital markets trading and securities custody in the four nations. Among MILA’s most relevant features is the fact that the markets lose neither their independence nor their regulatory autonomy, but maintain the premise of joint growth as an integrated market given the complementarities of their markets. All transactions in MILA occur in local the currency and with annotations on account through the local intermediary, which further enables international operations through this tool. Chile, Colombia, México and Peru integrate the Pacific Alliance, economic block that seeks to reduce the tariff and non-tariff barriers and more generally, promote economic cooperation among its members. In this way, MILA aims to become the financial arm of this Alliance, or, a fully integrated trading market that meets the financal, trading and post trading needs of an expanded Pacific Alliance. MILA Benefits

MILA today: Progress and achievements MILA has been established as a new investment pole in Latin America, integrating the markets of four countries with high growth potential through an online trading and information market, attracting the interest of both national and foreign investors and generating new businesses and opportunities, contributing directly to the growth of the capital markets. Currently, MILA is positioned as the largest market in the region, both in number of issuers and market capitalization. It has more than 700 issuers whose shares, due to the fact of being listed in one of the countries integrating this market, become automatically eligible to be traded in any of the MILA countries. With the addition of other variable income instruments, there are more than 1,000 instruments to be traded. MILA is recognized worldwide and has been able to show itself and each one of the markets comprising MILA as an investment alternative in Latin America. MILA has more than 4 committees which are continuously defining the development projects entrusted by the Executive Committee composed by the general managers or presidents of the participant markets and depositories meeting the needs of the market. Each of these groups incorporates the vision of the four countries with a work agenda that allows improving operational, legal, technological, custody and settlement matters, as well as promoting them commercially. In that sense, the Executive Committee plays an essential role in the integration, which has as its purpose to offer extended access to diversification and funding in order to comply with the challenge of increasing the investment flows within and towards the region, thus, allowing MILA to project as a relevant investment pole, both to local and international investors. MILA Day Two MILA DAY international editions were held with the purpose of consolidating the development of the Latin American Integrated Market and promoting its business opportunities among foreign investors. The first edition of MILA DAY took place in New York, in June 2013 with the participation of more than 300 investors, participants and authorities. The second edition of MILA DAY took place in October 2015, in the London Stock Exchange and the Deutsche Börse in Frankfurt. On the occasion, the representatives of the Markets and Depositories from Chile, Colombia, Mexico and Peru spoke about the investment opportunities that the integration of these emerging markets represents, the macroeconomic perspectives of these four countries, the OECD vision on the integration of the securities markets to boost competitiveness, as well as MILA’s goals and achievements during these four years, among other issues. Other milestones

MILA’s next steps Because MILA is in continuous progress and development, one of its challenges is to improve practices at structural and institutional level together with financial and capital market regulators and to allow that ever more business is performed in MILA by clients from the region and other countries, presenting increasingly fluid investment opportunities in a regional market with liquidity and with a promising projection in the long term. To achieve these objectives, MILA participants hope to continue receiving support from governments and authorities. It will be the public-private work which will allow for it to have all the means to advance in the consolidation of the capital markets in the region. In this second stage of MILA, the aim is to further deepen the cooperation instances, promoting liquidity, improving market prices, enhancing the delivery of information and perfecting the tax model. With regard to the joint work by the authorities – regulators from the 4 countries – market and depository executives have presented MILA Supervision Committee with a work plan for standard-setting and regulatory development.

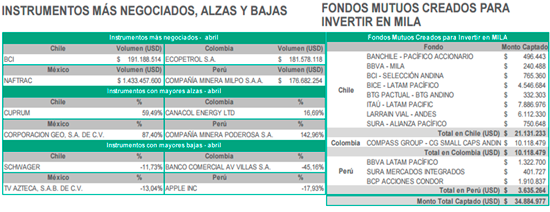

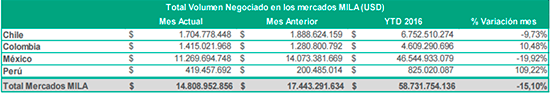

MILA in figures: (Spanish Only) Data with information as of April 2015 closing:

Noticias de servicios |

EN

EN  ES

ES