| MILA Markets News |

|---|

|

Dear Participant: Santiago, monday, january 16 2012

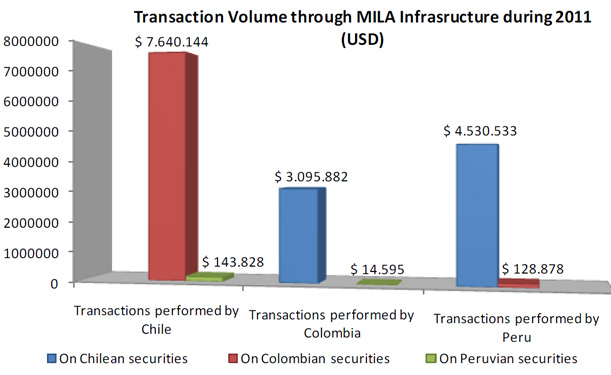

From its launch on May 30th of 2011, to the last trading day of the year, the total value traded in MILA reached USD $ 15.553.860, where 50% corresponds to transactions in Colombian equity securities (USD $ 7.769.022), 49% corresponds to transactions in Chilean equity securities (USD $ 7.626.415), and 1% in Peruvian equity securities (USD $ 158.423). It must be pointed out that December 2011 experienced the largest value traded of the year, with a total of USD $ 11.547.274.

During 2011, eight initial public offerings raised approximately USD $ 7.01million (COP 13 billion). The first company going public was Grupo Aval raising USD $ 1.149 million, followed by AviancaTaca who sold the total number of shares scheduled, equivalent to USD $ 280 million. In July 2011, Grupo Nutresa raised USD $ 296 million, which represented an excess demand of 17 times the offered shares. In the case of Ecopetrol, the Colombian state- owned oil company, raised USD $ 1.300 million in September 2011, in spite the turbulence generated when Standard & Poor’s removed the United States government from its list of risk-free borrowers by cutting its rating of long-term debt to AA+, one notch below the top grade of AAA. Later on, Éxito, Empresa de Energía de Bogotá, Banco Davivienda and Grupo Sura raised USD $ 1.406 million, USD $402 million, USD $ 374 million and USD $ 1.800 million, respectively. As a result, Colombia experienced a record year of initial public offerings in its equity market.

OUTLOOK FOR EQUITY SECURITIES LISTED IN COLOMBIAN SECURITIES EXCHANGE

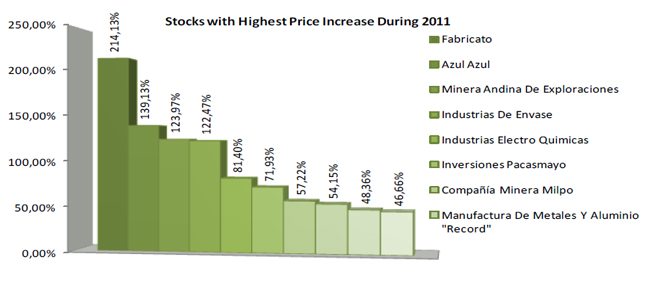

During 2011, several stocks listed in the BVC experienced clear adjustments in their market prices; however, companies such as Fabricato evidenced an upward movement in its price of 214% YTD. Éxito, Ecopetrol, Tablemac y Odinsa were also part the group of winners. Moreover, in spite of having gone through a difficult period for the equities market, Colombia experienced remarkable achievements such as the upgrade of Colombia's Credit Rating to Investment-Grade, the approval and final signature of the TLC (Free Trade Agreement) with the U.S., the GDP expanded 7.7 percent over the same quarter of the previous year.

For 2012 it is expected that oil companies listed in BVC will outperform the market, in terms of returns and earnings. At the top, there would be Petrominerales y Pacific Rubiales, followed by Canacol and Ecopetrol.

NEW PARTICIPANTS IN EQUITIES INDICES

The Colombian Securities Exchange (“Bolsa de Valores de Colombia - BVC”) completed a revision of the basket components for all equities indexes indices applicable during the first quarter of 2012, and some notorious changes took place. The first one corresponds to the replacement of ENKA by Petrominerales in the capitalization-weighted index - COLCAP.+

Regarding the IGBC index, also known as the general index, the most relevant change was the increase in the number of stocks in the basket, moving from 35 to 38. This increase is due to the addition of Petrominerales, listed on the Colombian Exchange during the first quarter of 2011, and due to the reappearance of Valorem y Corficolombiana (without dividend), given that they recovered their liquidity at the end of 2011 .

During 2011, Bolsa de Comercio de Santiago (BCS) confirmed its leadership in the Chilean stock market, with a 86.2% of market share. By taking into consideration all securities markets BCS market share increased to 97.6%.

MOST TRADED SHARES DURING 2011 AT THE BOLSA DE COMERCIO

During 2011 the most traded skocks in the Chilean stock market were LAN ($ 2.562.391 million), SQM-B ($ 1.897.010 million), CENCOSUD ($ 1.828.260 million), BSANTANDER ($ 1.430.113 million), FALABELLA ($ 1.273.473 million), ECL ($ 1.106.618 million), ENDESA ($ 1.052.280 million), COPEC ($ 1.008.707 million), ENERSIS ($ 850.526 million) and CAP ($ 839.816 million).

BOLSA DE COMERCIO TENDERS LOCAL ETFs

Bids on the tender of the first local ETFs were received on 4th January, 2012. The placing of ETFs on the most relevant and well-known indexes in the Chilean stock market, IPSA, IGPA and Inter-10, could be seen as the first step on the road towards developing a new ETF industry in Chile. A deadline for the evaluation and allocation of the winning bid has been set for March 30th of 2012, and it is expected to start its operations on the second semester of the present year.

LARRAÍN VIAL LAUNCHES A MORTGAGE FUND FOR CHILEAN AND PERUVIAN AFPs

LarrainVial, a Fund’s Investment Manager (SAFI) has plans to set up a second mortgage fund during January, 2012. Once all requirements with the Office of the Superintendent of Banks, Insurance and AFP of Peru have been met, it has been estimated that between USD 150 million and USD 200 million shall be raised, mainly from the AFPs, which in this instance will be both Chilean and Peruvian.

During 2011 the National Capitalization Index (INCA from the name in Spanish), the Lima Stock Exchange’s most representative index, fell by 22.4%. On the other hand, the value traded on stocks came close to Peruvian soles 16,852 million, which represents approximately a daily average of Peruvian soles 70 million, a 21% increase over 2010. During December of 2011, the value traded on stocks came to USD 391.78 million, compared to a value traded of USD 459.73 million during November, 2011.

MILA MARKETS – STATISTICS 30 - 12 - 11

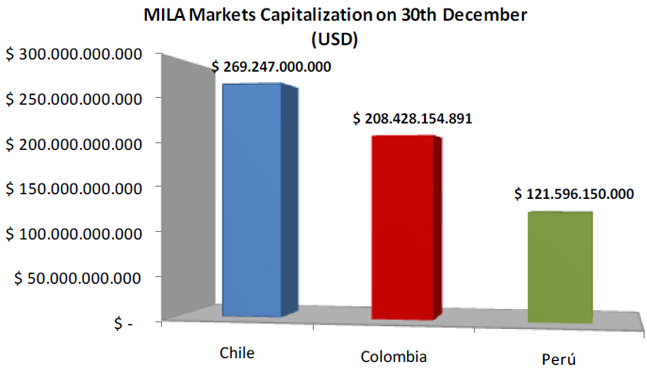

STOCK MARKET CAPITALIZATION IN THE MILA MARKETS

The equity market capitalization in MILA markets was US$ 599.271 Million at year end. Chile, Colombia and Peru had 44,9%, 34,8% and 20,3% market share, respectively.

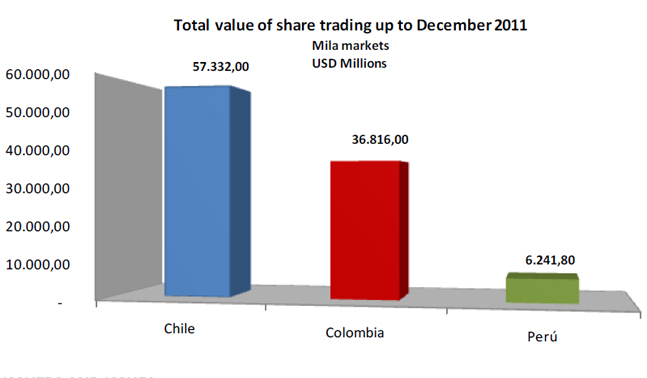

TOTAL VALUE OF SHARE TRADING IN MILA MARKETS

During 2011 total value of share trading in MILA markets reached US$100.389,8 Million. The highest market share was obtained by BCS with 57,1% (US$ 57.332 Million), followed by BVC with 36,7% (US$ 36.816 Million) and BVL with 6,2% (US$ 6.241 Million).

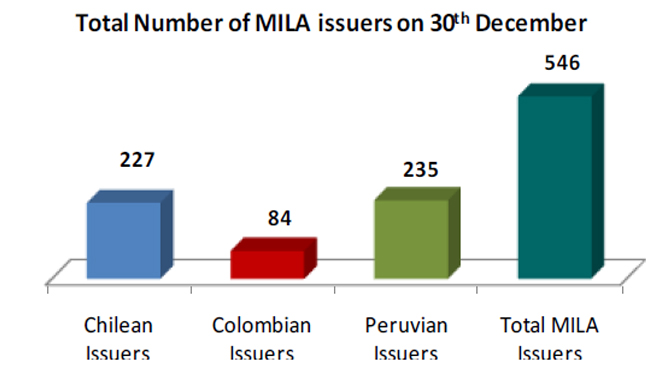

ISSUERS AND ISSUES

The number of Listed Companies in MILA at year end reached 546 companies, 20 of them from new issuers. There were 235 companies in the Peruvian market, 227 in the Chilean market and 84 in the Colombian market.

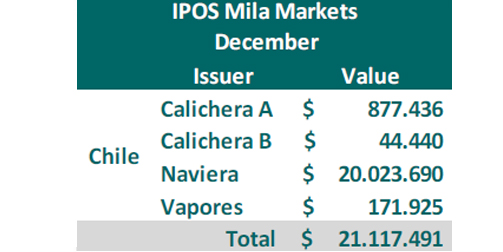

During 2011 there were 16 IPOS by US$8.756 Millions, where Colombia reached the 80,07% and Chile the 19,93%.

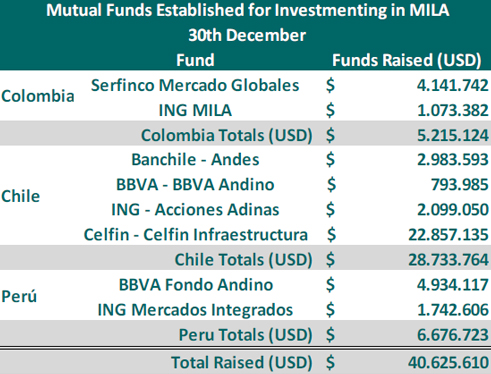

MUTUAL FUNDS CREATED FOR INVESTMENTS IN MILA

As a result of the market integration between the three stock markets, eight mutual funds have been established. Up to 30st December they had performed USD 40,6 Millions worth in transactions.

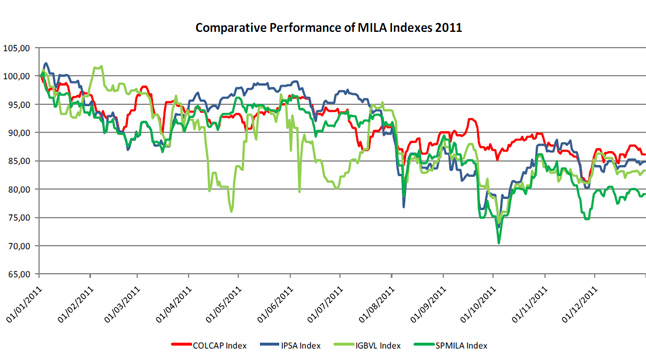

PERFORMANCE BY THE DIFFERENT INDEXES

The S&P MILA 40 presented a -20.96% fluctuation during 2011. The COLCAP (Colombia) index had a -13.83% during the year, followed by IPSA (Chile) index with a -15.22%, and finally, the IFBVL (Peru) with a -16.6 9%.

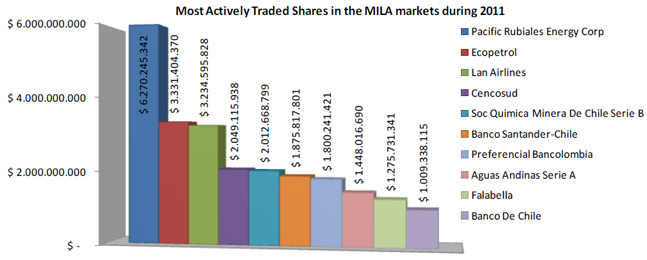

MOST ACTIVELY TRADED SHARES DURING 2011

During the year the most actively traded stocks in MILA markets were Pacific Rubiales Energy Corp, followed by Ecopetrol, Lan Airlines, Cencosud and Soc. Química Minera de Chile according to the traded volume.

STOCKS WITH THE HIGHEST INCREASE IN PRICE DURING 2011

During 2011, the stocks that reflected the highest increase in price in MILA markets were Fabricato, followed by Azul Azul, Andina de Exploraciones, Industrias de Envase and Industrias Electro Químicas.

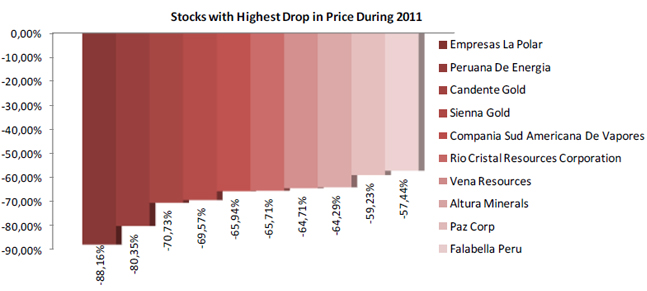

STOCKS WITH THE BIGGEST LOSS IN VALUE DURING 2011

During 2011 the stocks with the biggest loss in value in MILA markets were La Polar, followed by Peruana de Energía, Candente Gold, Siena Gold Inc. and Sud Americana de Vapores.

AGREEMENTS AND AGENTS By the end of 2011, there were 39 agreements in place between agents of the three participating countries.

TRADES THROUGH THE MILA INFRASTRUCTURE

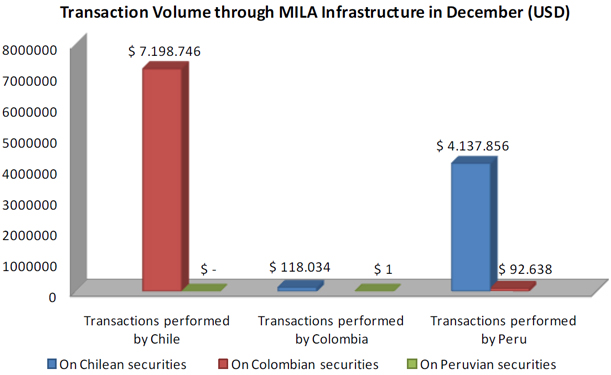

During December 2011, there were 215 trades executed through the MILA infrastructure and reached a USD $ 11.547.275. Chile had the largest percentage with 62.34% (USD $ 7.1 million) followed by Perú with 36.64% (USD $ 4.2 M)) and Colombia with 1.02% (USD 0.1M). The Colombian securities had the highest volume with an amount of USD 7.291.384 (63.14%).

By the end of 2011 the total number of transactions executed through the MILA infrastructure came to 611 trades worth USD 15,553,860. The Colombian securities reached USD 7.769.022 in total, followed by the Chilean securities amounting to USD 7.626.415 and the Peruvians worth USD 158.423.

MILA SECRETARIAT

DCV Noticias

|

EN

EN  ES

ES

USD 15.553.860 IN TRADING DURING 2011

USD 15.553.860 IN TRADING DURING 2011 RECORD NUMBER OF INITIAL PUBLIC OFFERINGS ON COLOMBIA'S BOURSE IN 2011

RECORD NUMBER OF INITIAL PUBLIC OFFERINGS ON COLOMBIA'S BOURSE IN 2011 BOLSA DE COMERCIO, THE LEADER OF THE CHILEAN STOCK MARKET

BOLSA DE COMERCIO, THE LEADER OF THE CHILEAN STOCK MARKET PERUVIAN MARKET PERFORMANCE DURING 2011

PERUVIAN MARKET PERFORMANCE DURING 2011