Estudio sobre conocimiento financiero en su Estudio sobre conocimiento financiero en susegunda versión reveló interesantes conclusiones.

The Depósito Central de Valores (DCV) together with the Center for Financial Studies of the ESE Business School of the Universidad de los Andes carried out the second version of the financial education study. In its 2020 version, the survey, carried out by Cadem, once again reviewed the Financial Knowledge Index, which this time shows progress compared to 2018, especially in relation to the products and institutions of the system. However, the level of general knowledge of the market and understanding of financial issues is still low.

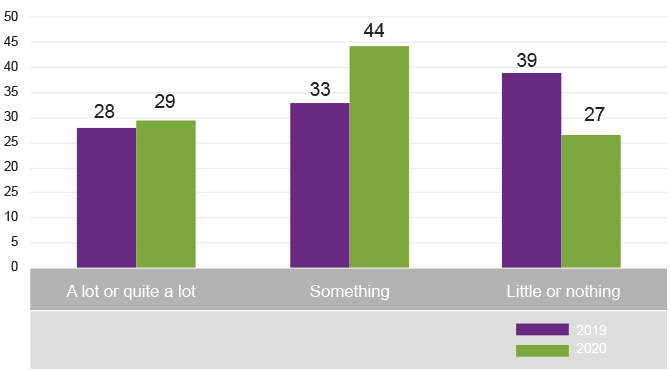

The following graph is evidence of this, where 71% of respondents indicate that they know “something, little or nothing” about financial matters. These are specific works and projects that directly benefit the strengthening of the Chilean capital market and its users.

Generally speaking, how much would you say you know about financial matters? (%)

The initiative, which constitutes a strategic alliance between the two institutions, seeks to amplify the work that the entities carry out individually, incorporating specific jobs and projects that directly benefit the Chilean capital market and its users.

“We saw an increase in knowledge on features and functions of financial products, and also about specific aspects of personal finance. We could say that the withdrawal of 10% of the AFPs has contributed to this area”

Javier Jara Traub, Legal and Corporate Affairs Manager of

the Depósito Central de Valores (DCV).

It was also possible to observe an improvement in the Financial Knowledge Index (which is built with the different variables of the survey), which went from reporting a high financial knowledge of 16% in 2018 to 29% in 2020. He adds that this increase is reflected mainly in men (from 19% to 37% in two years), people 55 years of age or older (from 17% to 41%). “However, the knowledge gaps between women and men, ages and socioeconomic groups are worrying,” warns Jara.

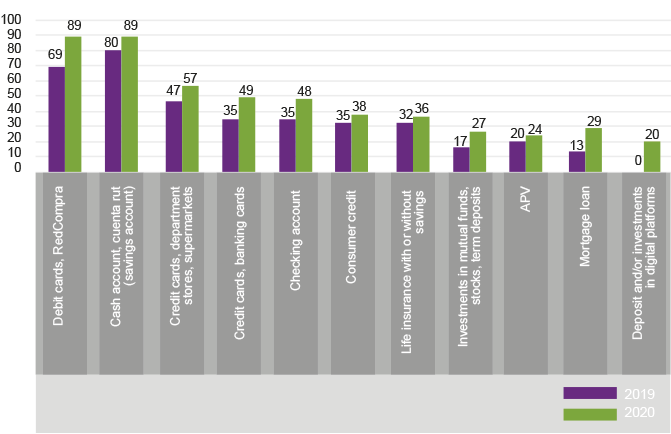

Ownership of financial products, do you currently have ...? (% Yes)

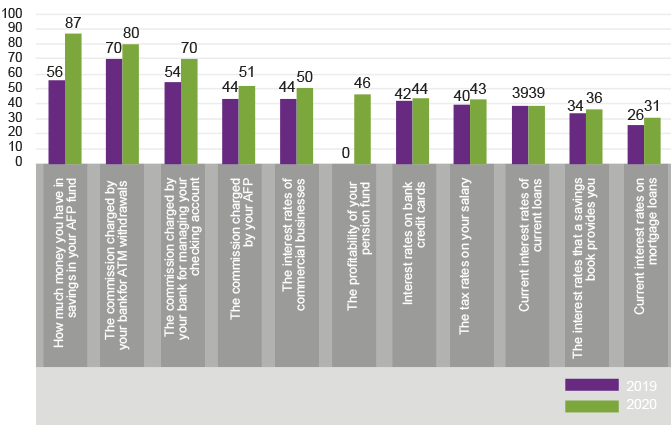

In general, do you know or are aware of ...? (% Yes)

The 2020 study incorporated metrics to evaluate the degree of sophistication of clients to know if they understand in some way or another what interest rates, inflation and investment risks are. This exercise shows that there are significant gaps by age, gender, and socioeconomic group.

Despite the fact that only 27% say they have investments in mutual funds, stocks or term deposits, these are the topics that reveal the most interest when consulting people.

News Center

EN

EN  ES

ES