This year 2020 will definitely mark a tipping point in the forms and dynamics in the realization of these corporate events .

During the first four months of this year, local sociedades anónimas, despite the difficult circumstances, managed to develop their ordinary shareholders meetings (an annual event, in which the board reports to investors on the current operations and its future plans). In addition, the financial statements are approved and, in some cases, the board of directors, the external auditor, the risk rating agency are renewed, and the dividend payments are approved. For the payments made by DCV Registros (DCVR), an affiliate company of the Depósito Central de Valores (DCV), in the months of March, April and May, this sole event injects the economy with an amount close to $2.7 trillion, i.e., US$3.5 billion, which are payments that would not have been possible without holding the meetings.

The following report analyzes the participation of shareholders in these meetings. For this, a sample was taken of the companies that make up the SP IPSA index and whose shareholder registries are managed by DCV Registros (DCVR). In total, of the 30 SP IPSA companies, 22 maintain their shareholder registries with DCVR, i.e., 73.3%. And of the 22 companies managed by DCVR, 15 held their shareholders meetings with this entity remotely or face-to-face.

“Regarding the number of shareholders of the companies analyzed (15 SP IPSA companies), there is an important diversity in the sample; from firms with less than 300 shareholders to some that exceed 22 thousand. On average, the total number of shareholders is 5,612 individuals or legal entities (a figure that includes stockbrokers, international custodian banks, among other institutions that represent other investors)”.

Claudio Garín, Operations and Services Manager of the Depósito Central de Valores (DCV).

Regarding the quorum -number of shares represented at the shareholders meeting with respect to the total shares issued by the company-, Claudio Garín, Operations and Services Manager of the Depósito Central de Valores (DCV), explains that, given the ownership structure of the majority of local sociedades anónimas abiertas, a small number of investors represent a significant percentage of a company’s shares. This is how, in most cases, attendance quorums exceed 80%. During 2020, the average attendance quorum of the companies in the sample was 89.3%, a percentage similar to that recorded in the same period last year.

While on average in 2020, in ordinary meetings of the sample, 19 attendees participated (including shareholders and proxies or their representatives). These attendees represented an average of 2 shareholders per meeting, which means an average participation rate of 1.3% of the total shareholder base of the companies.

Total issuers and remote shareholders meetings

Given the contingency caused by the expansion of the coronavirus (declared a global pandemic by the WHO, and according to the publication of Regulation No. 435 of the Commission for the Financial Market, CMF, which regulates the mechanisms for remote participation and voting for shareholders meetings, bondholders and assemblies of contributors), DCVR made its shareholders meeting services available to the market in its traditional format, i.e., face-to-face, and incorporated the new remote service with electronic voting for shareholders and contributors. This mechanism permitted the management of the voting process remotely, through a platform that uses blockchain technology that provides information security, trust, and traceability.

Additionally, DCVR created a prior registration system for shareholders who would attend the meeting, which consisted of structuring the shareholder base and making verifications to guarantee the identity of those who would attend the meeting.

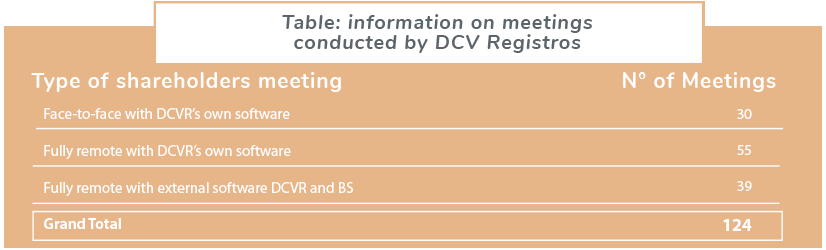

Thus, during April of this year, DCVR held 124 meetings of which 52 were held completely remotely with software provided by DCV and the Santiago Stock Exchange.

Regarding the shareholders meetings of the SP IPSA companies whose registries are managed by DCVR, four were carried out completely remotely: Grupo Security, Salfacorp, Sonda and CCU.

Claudio Garín comments that, among the advantages that exist in holding remote meetings is that it allows shareholders to be able to attend and vote in several meetings from their offices, without the need to move; similarly, the possible participation of shareholders that are distant from the physical location of the event; representatives of foreign shareholders participate remotely and cover more than one meeting at a time, among others.

While in terms of its disadvantages, the following stand out: face-to-face contact is lost (even when there is an online transmission of the event carried out by the issuer); it hinders the participation of certain shareholder segments; participation in terms of the right to vote and the dependence on having a good internet connection become more complex.

“Without a doubt, 2020 will mark a turning point in the forms and dynamics in the realization of these corporate events and it is valid to expect that instances with face-to-face, remote or mixed participation will be combined, thus expanding access to the extent technology accompanies the operational processes”.

Claudio Garín, Operations and Services Manager of the Depósito Central de Valores (DCV).

News Center

EN

EN  ES

ES