|

Vision, definition, growth and management have been part of the fundamental concepts for Depósito Central de Valores (DCV), which have allowed it to declare management based on risk a strategic pillar within the organization.

Claudio Herrera, Operational Risk Assistant Director, stressed the support and investment undertaken by DCV in order to develop a Risk Management software solution with the purpose of optimizing the timeliness, improving analyses and providing valuable information for decision making processes.

“DCV is market infrastructure and as such, we manage risk as part of our business. What we cannot do in DCV is to incorporate risk to the market; since we are the only securities depository in Chile, risk management constitutes a relevant pillar in the organization. For that, the senior management has boosted this area and made the necessary investments in search of a world class software which is to say among the top places worldwide”, he explained.

In 2012, DCV decided to acquire software with particular characteristics in the sense that it is not the tool that is relevant, but the model developed from the tool. “The complexity of the implementation led us to become a world reference, and implied being in contact with a series of institutions within the financial market and other areas, which in some way are in a very similar search to the one we had some years ago”. He said that such acknowledgment has been interesting because they have met with actors who are benchmarks regarding technological issues, as well as international banks and other securities depositories.

Herrera explained that DCV has been invited to present in cities such as Las Vegas, Orlando, and to participate constantly in events that allow for having feedback on the risk model inherent to each organization, i.e., non-replicable.

Another important aspect is that the area constantly checks the value the model adds to the organization relating to the information obtained and the associated risk management. “Today we spend more time in analysis that in the data, which was previously the reverse. This allows for better analysis of the information and correlating issues, which has made a great difference because it allows it allows to deal transversally in the organization that is part of the project, issues connected to incident management and analyzing scenarios that may be contingency locally or worldwide.”

The executive stated that the implementation of the tool is a dynamic process as new dimensions have been added to Risk Management as DCV grants new coverage and services to its clients.

“In DCV the availability of the service is essential, as well as the security of its operations; these are issues that are certainly present at all times in Risk Management: continuity, availability, security are essential because they affect our clients”, he emphasized.

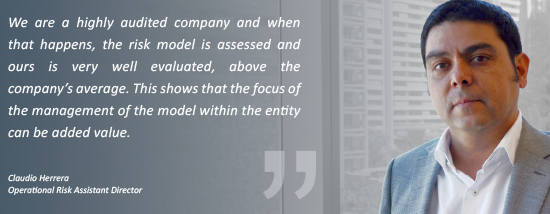

At the same time, Herrera says that the information generated by the tool has not only allowed them to grow and use it in projects and for measuring DCV services, but has also supported the company in other relevant processes such as the certification of their processes.

“We are a highly audited company and when this happens, the risk model is assessed and ours is very well evaluated, above the company’s average. This indicates that the management of the model is done within the organization has a focus in which it can add value”.

Support

The Risk area was created in 2008 and is currently comprised of nine collaborators who have reached significant levels of efficiency from this new tool. For Herrera, the key in this process – beyond doubt – has been the vision and support from the executive and management levels, which has allowed it to position within the company culture as well.

“The great value in this matter has been the vision of the Executive to project itself, to make an investment, but with an idea, with respect to DCV, in terms of clearly understanding that within their management, handling risk is also part of their business. It has been seven years, and three since we turned to having a tool that made the difference.

In addition, it is also used by the Auditing and Controller areas, and it is basic information that we also use for all committees. We are in a stage where we want collaborators to further interact with the system”, he said.

DCV Noticias |

EN

EN  ES

ES