Sandra Valenzuela, People Management Manager at Depósito Central de Valores, reviews the greatest milestones of 2022.

There is no doubt that 2022 was a challenging year for DCV. Our Company celebrated the successful launch of DCV Evolution, the state-of-the-art platform for the financial system based on Nasdaq CSD technology.

This change came to streamline our services, operating with improved performance, speed, and scalability. Similarly, it provides securities custody and settlement services at a local and international level and improves the services in the entire Chilean financial ecosystem.

This success was achieved thanks to the strong commitment and the cooperative and dedicated work of DCV's team. For over three years, more than fifty collaborators from different departments focused on launching this project, which makes us feel very proud.

"Transformation will become an ongoing process that will be our ally in the future. We are convinced that the most important aspect of this transformation is the people involved in it because they contribute with sustainability in change by making this progress a part of our Company's corporate culture," says the People Manager.

This great innovation, which we call "DCV Evolution," completed its deployment in September. The project contributes to developing the capital market because it facilitates interconnection with international markets and promotes - together with other sector-based initiatives - the development of new added-value services.

The concern about financial education

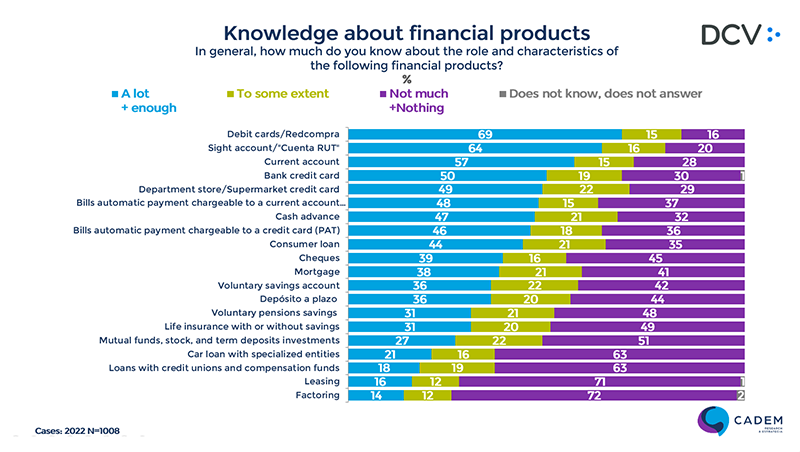

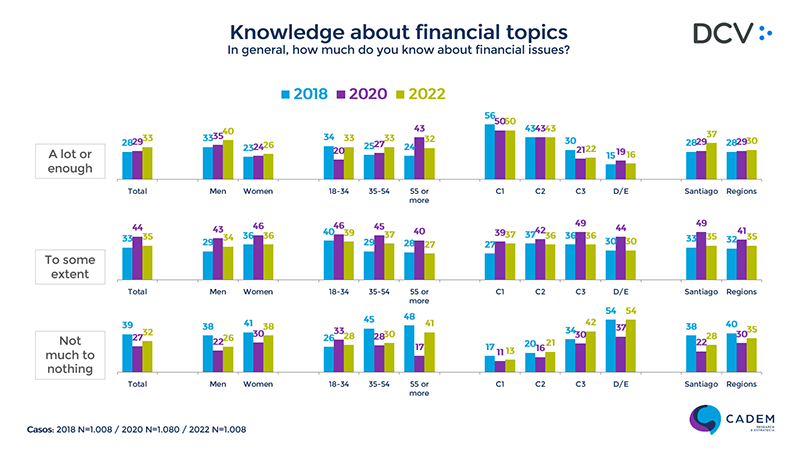

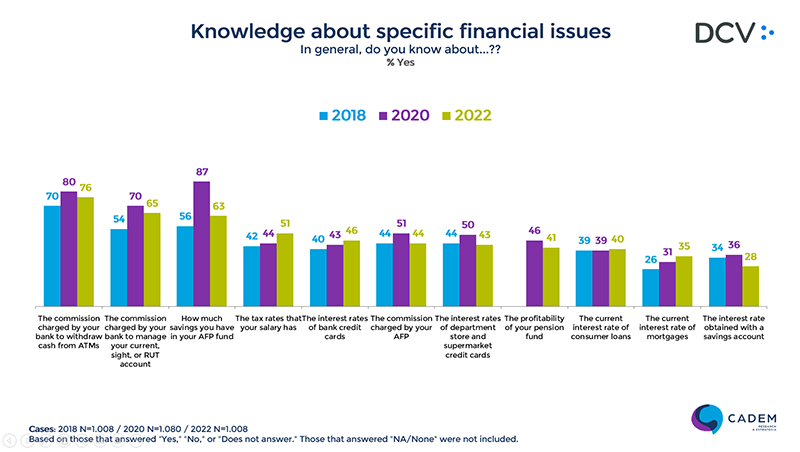

42% of Chileans have a low level of financial knowledge, 21% high, and 37% average. These concerning conclusions were revealed in the new version of the Financial Knowledge Index (ICF in Spanish) that we created with CADEM. Why are we concerned about this? "Because to make progress in a capital market that is more connected to people, the level of knowledge of the population matters."

This is a challenge for the entire country that will take years to change. And as DCV is motivated to contribute during the process, we created an Inclusion and Financial Education Committee (Mesa de Inclusión y Educación Financiera, MIEF) with Centro de Estudios Financieros, ESE Business School of Universidad de Los Andes.

According to experts, 2023 will not be very favorable in economic terms. However, Valenzuela says, "our Company will be contributing to strengthening the financial market as we have committed to doing so for almost 30 years."

News Center

EN

EN  ES

ES