|

| |||||

|---|---|---|---|---|---|

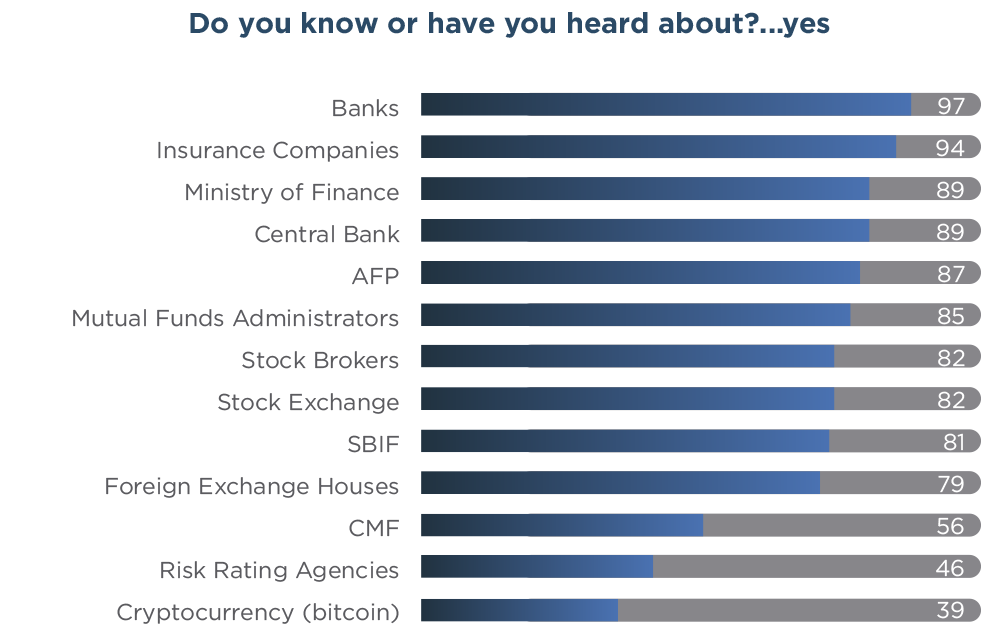

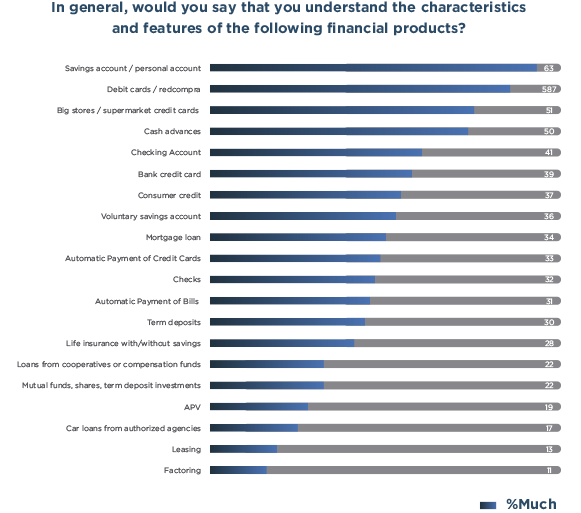

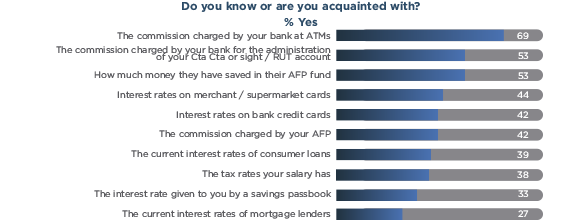

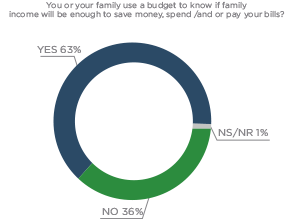

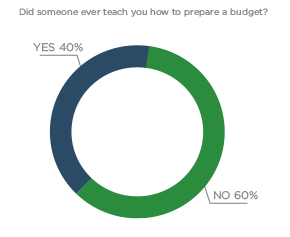

REVEALS THAT 53% OF THE CHILEANS HAVE LITTLE UNDERSTANDING OF FINANCIAL INSTITUTIONS, FINANCIAL PRODUCTS AND FINANCE CONCEPTSSantiago, October 13th, 2018. The survey, carried out throughout the country, also showed that 31% and 16% of the respondents have a medium and high score on the FLI, respectively. The Financial Literacy Index (FLI) prepared jointly by Depósito Central de Valores (DCV) and Cadem, revealed that 53% of the Chileans have little understanding of financial institutions, financial products and finance concepts. The survey, conducted throughout the country, also showed that 31% of the respondents have an average score on the FLI, while only 16% of the population reaches a high score on the FLI. By gender, 58% of women showed little understanding. For men, this was 48%. By age and socioeconomic level, the highest percentage of the population with low score on the FLI was people over 55 years old (59%) and in the D/E socioeconomic segment (72%). Javier Jara Traub, Business Manager of DCV, explains that the Company wanted to contribute with a simple but profound measurement of the level of financial literacy in our country. “Financial education has been the main topic this month and being able to measure that education is important. Hence, this index will allow public and private players to take measures aimed at helping Chileans to make better financial decisions, both personally and for their families”. Results by Dimension The Financial Literacy Index measures the understanding on three dimensions: financial institutions; financial products and finance concepts, such as commissions and interest rates. When analyzing whether Chileans properly understand their financial institutions or not, the FLI showed that, in general, they do know about the existence and operations of banks, insurance companies, the Ministry of Finance, the Central Bank and AFP (figure 1). Now, when analyzing their understanding of financial products, more than 50% of the population properly understood the characteristics and features of the following products: savings account / personal account; debit cards/ Redcompra; big stores / supermarkets credit cards; and cash advances (figure 2). The same occurs when analyzing the understanding of these financial concepts. There is high understanding only in connection with commissions charged by banks for withdrawing money from ATM (69% say they do understand them). In other matters, such as interest rates for consumer credits or mortgage loans, savings in AFP accounts or commissions for the use of financial products, there is medium or little understanding (graph 3). Family budgets To compare the results of the FLI, DCV conducted a survey to analyze the financial behavior of Chileans. Specifically, in connection with the management of family income. The results showed that 63% of the respondents prepare a budget to know how much they will save, spend and/or to know how much they need to pay their bills. The foregoing, despite the fact that 60% of them said that no one taught them how to prepare a budget (figure 4 and figure 5).

About DCV Depósito Central de Valores (DCV) is a custodian of different financial products traded in the local market. As of August 2018, DCV maintains securities in custody for US $ 381.3 billion (9.219, 2 Million UF). In addition, it is responsible for registering all transactions carried out in the local market and offers management services for shareholder registries, collateral and statistical reports, among other matters. More information www.dcv.cl

DCV News |

|||||

EN

EN  ES

ES