Monthly newsletter on the Latin American Integrated Market MILA. April 2012 Edition...

| MILA market news |

|---|

|

Dear Participant: Santiago, Thuesday 24 april, de 2012

So far in 2012, the three member countries of MILA have had dynamism positioning them as leaders with regard to the Market Cap. This first quarter, Colombia, Peru and Chile grew 28%, 20% and 17% respectively, rates that are in line with growth rates of emerging economies. Currently, the two focal points of attention in the region, Brazil and MILA, account for 4.85% of the global Market Cap. The countries of the Latin American Integrated Market and Mexico - months away of integrating MILA - account alone for 2.22% of the world Market Cap.

Stock Exchanges of Chile, Colombia, Peru and México participated at the MILA Seminar.

The Santiago Chamber of Commerce, the Chilean- Colombian, Chilean-Peruvian and Chilean-Mexican Bi-national Chambers of Commerce, with the support of the BCS, held on March 14th the seminar “Latin American Integrated Market, Opportunities and Challenges”. Participants included the highest level representatives of the stock exchanges of these countries: BCS general manager, Jose Antonio Martinez; BVC president, Juan Pablo Cordoba; BVL general manager, Francis Stennig; BMV general director, Pedro Zorrilla and the Minister of Finance, Felipe Larrain, who performed the opening ceremony. In this regard, the BCS General Manager, Jose Antonio Martinez, highlighted that “MILA generates a virtuous circle benefiting both, the local and international markets. Through this initiative the liquidity of the markets is increased, economies of scale are created, and regional businesses are increased through the new generated products”.

The construction and real estate company –Ingevec- had a successful debut at the BCS with a demand exceeding the offer by eight times. The collection reached approximately USD $26 million for 30% of the ownership, amount that will be directed to fund part of the company´s strong expansion process. The ceremony was transmitted from the BCS via streaming through its website. Thus, from 09:00 hours the world could be part of Ingevec´s debut. There were connections with the event from the United States, Peru, New Zealand, Europe, Canada, among other. This innovation will be repeated hereinafter with all Chilean market openings.

Itau enters into an agreement with BCS to create ETF funds in the local market.

An important step for the development of the capital markets was finalized on March 27th, after Itaú Administradora General de Fondos entered into an agreement with BCS to create ETF funds (Exchange Trade Funds) of their main indices (IPSA, IGPA and Inter 10). According to projections the creation of the stock exchange indices ETF will promote greater liquidity in the BCS; contribute to the development of variable income derivative instruments, and promote the BCS indices brands in the international market, attracting more foreign investors. In the project developed by Itau, LarrainVial Corredora de Bolsa was selected to perform the role as “market maker” and “authorized agent” of the funds launched. Both entities will be responsible for the product placement process, which will involve Chile, the Andeanregion and the international market.

During the first quarter, share trading through the BVC reached a total of US $4.77 billion (includes Repos operations), placing this period as the most dynamic in share trading in the history of such stock exchange. The most dynamic month of the quarter was February, period in which a total of US $4.74 billion were traded. According to analysts, the satisfactory dynamics of the Colombian stock market is attributed to an upturn in share prices, which has led the benchmark index, the COLCAP, to accumulate a 10.95%.increase during the year. Foreign investment continues to grow in the BVC.

At the closing of the first quarter foreign investors had made operations in the BVC for up to US $1.6 billion, of which US $1.05 billion were purchases and US $640 million were sales. This means that the net position of these investors was positive by US $413 million as of the term´s closing. Comparing the share with other investors, foreign investment (adding individuals and funds) reached 10.10% during 2012 first quarter. For 2011 first quarter the share of foreign investors in the stock market was 4.35%.

The BVL closed the first quarter with a positive profile, accumulating a return of 19,8% so far, after earning 2,67% in March, 3,56% in February and 12,7% in January. In the first quarter, the stock exchange capitalization (shares value) listed in the BVL was increased by USD $ 17.7 billion, until reaching USD$ 140 billion. Several factors have promoted the BVL, but the most important was the generalized increase of metal prices linked with the global economy´s favorable expectations.

Index of the companies with sound corporate practices.

Peru, Brazil, Shanghai and Istanbul are the only exchange markets that have indices that exclusively measure the stock exchange performance of companies with sound corporate practices. Currently, the IBGC has a 39% market premium compared with the Selective Index, and of 20% compared with the INCA. This index is the stock exchange indicator reflecting sound performance of share prices of companies that adopt corporate governance best practices added to sufficient liquidity.

MILA Markets statistics March 2012

STOCK MARKET CAPITALIZATION OF MILA MARKETS Stock market capitalization of MILA markets closed March at US $721,074 million, with a variation of 2.16% when compared with the data recorded for February. The share in the value of companies listed by market is distributed as follows: Chile 44.94%, Colombia 35.64% and Peru 19.42%.

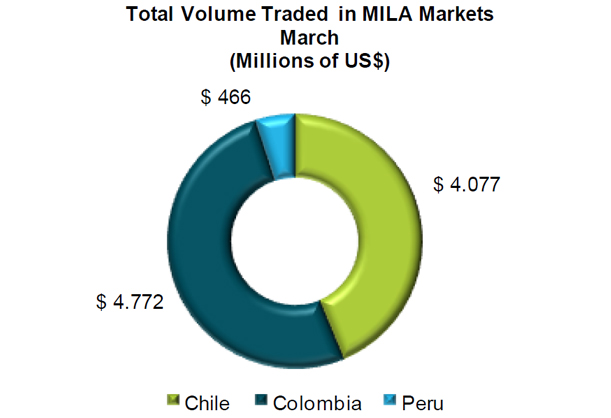

TOTAL TRADED VOLUME OF MILA MARKETS

The total volume of trades in MILA markets in March reached US $9,315 million, with a variation of 7.42% when compared to the previous month. The largest number of operations was recorded by BVC with 51.23% (US $4,772 million), followed by BCS with 43.77% (US $4,077 million) and BVL with 5.01% (US $466 million). So far in 2012, the total volume traded in MILA markets is US $26,018 million.

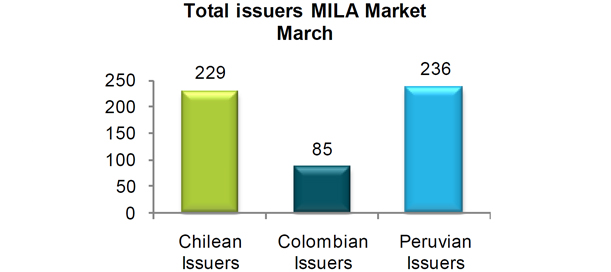

ISSUERS AND ISSUES OF THE MILA MARKETS

In March 2012 the Latin American Integrated Market reached a total of 550 listed companies, one of which was a new issuer (chilean) listed in March.

In March, US $12 million were invested in IPOS´s of MILA markets. Chile represented a share of 100% in new issues, after accruing US $12,406,242.

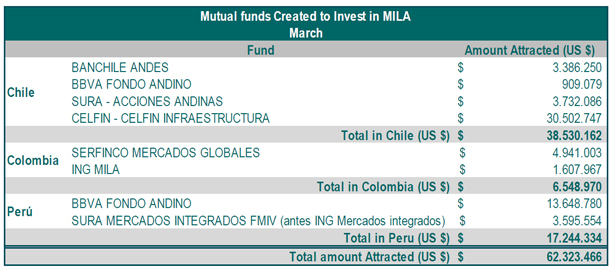

The total amount attracted by the eight mutual funds currently in the three stock exchanges comprising

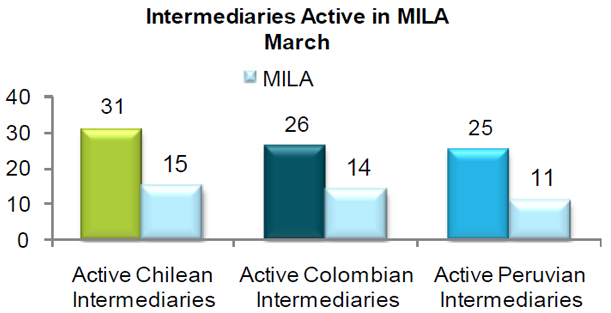

MILA MARKET INTERMEDIARIES AND AGREEMENTS

By the end of March, there are 82 active intermediaries in the three exchanges, of which 40 have actively operated through the MILA infrastructure.

By the end of March, there were 43 agreements in effect among the stock exchanges of the three stock markets.

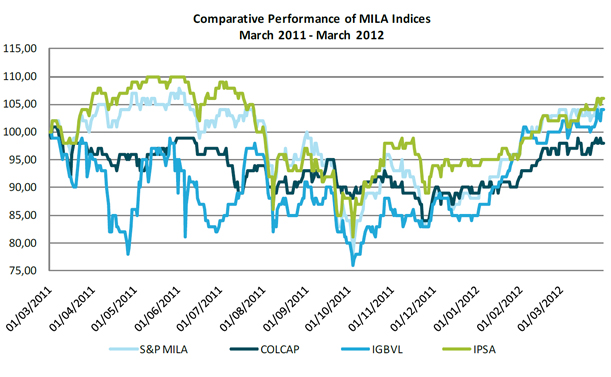

PERFORMANCE OF MILA MARKET INDICES

The S&P MILA 40 showed a 0.35% variation for the close of March, the IGBVL (Peru) showed a 21.25% variation, followed by the IPSA (Chile) with 11.81% and finally COLCAP (Colombia) index with 10.95%.

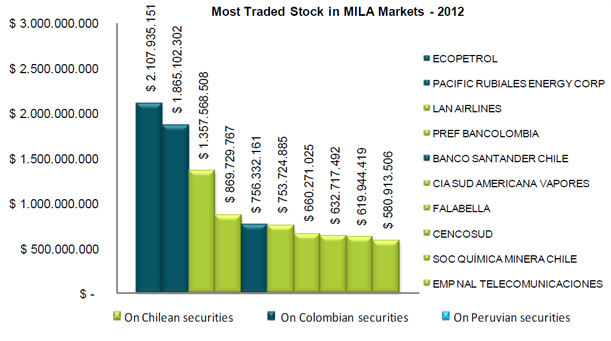

MOST TRADED STOCKS IN MILA MARKETS

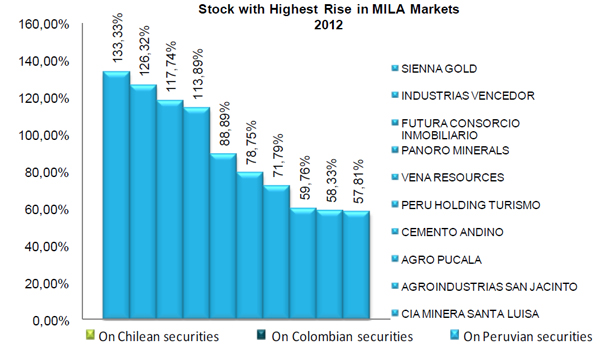

STOCKS WITH HIGHEST RISE IN PRICE

In March, the stock experiencing the highest hike in Price in the three MILA markets was Sienna Gold with 63.33% growth, followed by Empresas La Polar with 48.57%, Energia del Pacifico with 47.32%, Compañia Minera Santa Luisa with 43.96% y Banco Av Villas with 33.20%. So far in 2012, stocks with the highest rise in prices have been: Sienna Gold with growth of 133.33%, followed by Industrias Vencedor with 126.32% and Futura Consorcio Inmobiliario with 117.74%.

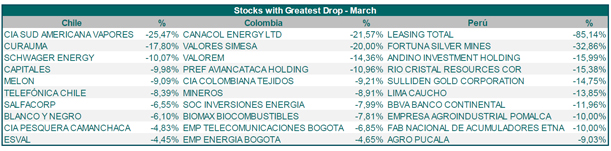

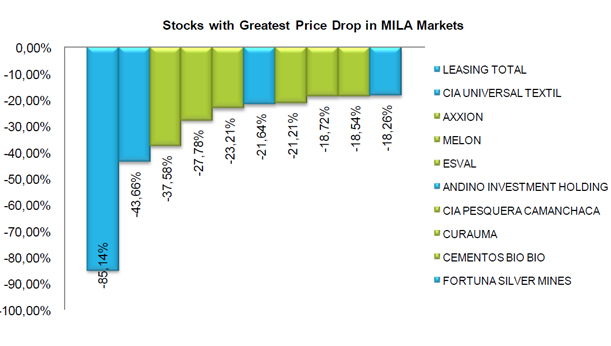

STOCK WITH THE GREATEST DROP IN PRICE

In March, the stock experiencing the greatest drop in Price in the MILA markets was that of Leasing Total with -85.14%, followed by Fortun Silver Mines with -32.86%, Compañía Sudamericana de Vapores with -25.47%, Canacol Energy with -21.57% and Valores Simesa with -20.00%. So far in 2012, the stocks with the greatest drop in prices have been: Leasing Total with -85.14%, Compañía Universal Textil with -43.66% and Axxion with -37.58%.

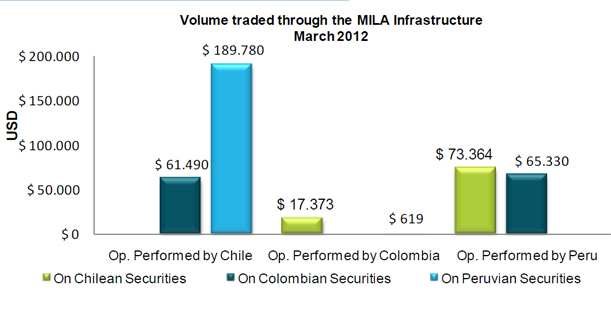

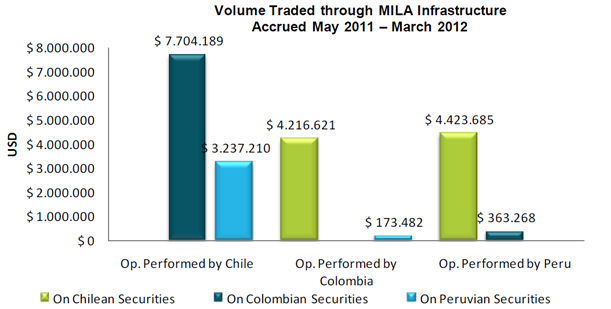

OPERATIONS THROUGH THE MILA INFRASTRUCTURE

During March, 37 operations were carried out through the MILA infrastructure for a total of US $407,956. Chile had the highest participation percentage of these transactions, with 61.59% (US $251,270), followed by Peru with 34.00% (US $138,694) and finally Colombia with 4.41% (US $17,992) when compared with the total amount of the operations. The Peruvian species were the ones with the greatest trading volumes in March, amounting to US $190,399 equivalent to 46.67% of stock movements.

By the end of March operations accrued through the MILA Infrastructure reached US $20,118,455, with a total 782 operations. Chilean securities were the ones most traded for a total of US$ $8,640,306 (42.95%), followed by Colombia with US $8,067,457 (40.10%) and Peru with US $3,410,692 (16.95%).

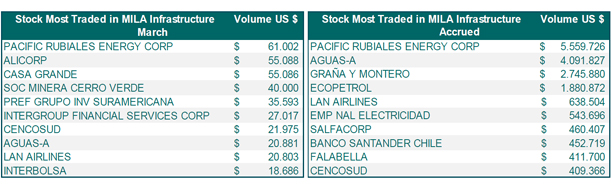

STOCK MOST TRADED THROUGH THE MILA INFRASTRUCTURE

The most traded stock in Marzo through the MILA infrastructure was the colombian stock of Pacific Rubiales Energy Corp. with US $61.002, followed by Alicorp, Casa Grande, Soc Minera Cerro Verde and Pref. Grupo de Inv. Suramericana. By the end of March, the most traded stock through the MILA infrastructure since their listing are: Pacific Rubiales Energy Corp., with an accrued total of US $ 5,559,726, followed by Aguas A, Graña y Montero, Ecopetrol and Lan Airlines.

MILA SECRETARIAT

DCV Noticias

|

líderes en capitalización

bursátil en la región.

EN

EN  ES

ES

Chile, Colombia and Peru leaders in the region´s stock exchange capitalization.

Chile, Colombia and Peru leaders in the region´s stock exchange capitalization. Successful debut of Ingevec at BCS

Successful debut of Ingevec at BCS New record in trading shares throughout this quarter.

New record in trading shares throughout this quarter. Excellent performance of the BVL in the first quarter

Excellent performance of the BVL in the first quarter