Among the main opportunities are open banking,

innovation, and companies digitization.

While the main challenges have to do with regulatory uncertainty,

recruitment, talent retention, and financing.

To get to know more about the economic point of view of the Fintech industry, Depósito Central de Valores (DCV), Diario Financiero, FinteChile, and EY Chile, created a partnership to conduct the third version of the Fintech Expectations Survey, where relevant information about its characteristics, business expectations and their view on the country’s economy was collected. An online event was held with the participation of Mauricio Martínez, partner of EY, Ángel Sierra, Executive Director of FinteChile, Rodrigo Krell, Executive Secretary of the National Commission of Productivity; Isabel Ramos, International Editor of DF and Javier Jara Traub, Legal and Corporate Affairs Manager of DCV to present its results and analyze specific topics.

The sector is becoming more relevant and contributes to the inclusion of traditionally left out segments that could not access the traditional financial industry systems. This survey becomes of particular interest to obtain more information on how these companies have handled the pandemic, the forecasts for their businesses, and their main challenges and opportunities. In addition, a particular focus was placed on the recent delivery of the Fintech bill of law from the Executive.

During the meeting, the panelists commented on the importance that this sector is acquiring and that Chile is currently the country with the highest Fintech companies penetration of the region.

Javier Jara mentioned that globally, innovation in the financial sector is mainly taking place through Fintech companies. “At DCV, we have innovated through partnerships with Fintech companies; these kinds of partnerships are very interesting.” For instance, we created a platform called AUNA with the Santiago Stock Exchange and GTD, and we developed an e-voting system called Click&Vote,” he added.

Main Results

After surveying Fintechs on the current situation of their businesses, 84% answered that it is “Very good” or “Good,” and only 9% indicated that their sales had decreased over the last year; 94% expect for them to grow in the following 12 months. 96% expect to hire talent, and 74% plan to make capital investments. When asked about how the sector would come out of the pandemic, the answers are inclined towards growth, more regulations, and increased profit.

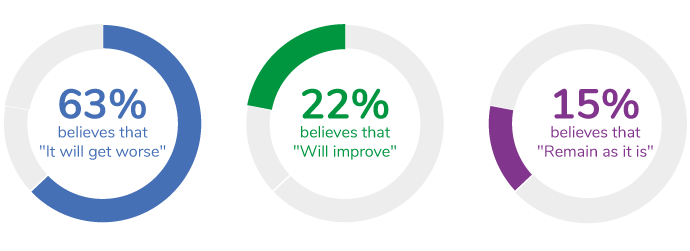

The above does not match the answers provided on the evolution of the Chilean market. 63% believe that it will “worsen” and 15% that it will “remain as it is,” whereas only 22% think that it will “improve.”

What is the forecast for the Chilean economy?

"In this third version of the survey, we see once again that the expectations from Fintechs are very positive. However, there is a contrast when asked about the country’s economy. The above is starting to become a trend and a reflection of the expansion and the view that this energetic industry has.”

Javier Jara Traub, DCV Legal and Corporate Affairs Manager.

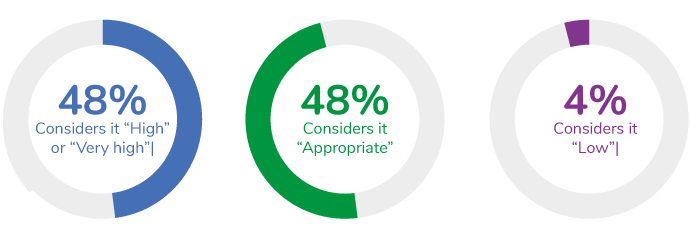

Regarding the bill currently being discussed in Congress that intends to regulate the sector, the vast majority (87%) has a good opinion. However, there are several views on the regulatory burden that it proposes: 48% considers it as “high” or “very high,” the same percentage as “appropriate,” and only 4% as “low.”

Fintech Bill of Law Being Discussed in Congress that Intends to Regulate the Sector

On the other hand, financing through hedge funding represents the last step in this industry’s maturity. It is one of the three most relevant challenges of the sector, together with regulatory uncertainty, recruiting, and talent retention, that is on top of the list.

About their Characterization:

The surveyed Fintech companies are highly centered in the Metropolitan Region (96%) and the “Banking, Payment, and Transfers,” “Crowdfunding & Lending,” and “Financial Management” sectors.

72% of the surveyed firms have between 0 and 50 and only 6% more than 200 collaborators. As per their annual sales, 30% invoice more than 50,000 UF and 24% below 2,500 UF.

Most of them are two years old (22%), while 17% are ten years old or more.

Regarding their participation in ownership, it is mostly from founding partners followed by non-founding partners. 43% have participated in investment round tables, and approximately half only operate in Chile (52%), where Peru has 33% of the preferences, and it is the second country where local Fintechs have expanded.

The survey took place between October and November of this year, and it comprised 54 Fintech companies

Check the entire survey (PDF).

Video of the EVENT | Evolution of Chile’s Fintech Industry

EN

EN  ES

ES