| Circular | Annex | Date | Reference | Status | Download |

| 358 | no | 04.15.2024 | Change in the Settlement Flow in the USA Market and its Impacts in the Cross-border Custody Service |

In effect | No |

DEPÓSITO CENTRAL DE VALORES S.A.,

DEPÓSITO DE VALORES

Dear Participants,

As informed in previous bulletins, the United States market's settlement flow will change from May 28 from T+2 to T+1 (SEC Rule 15C6-2). In that respect, DCV has analyzed the impacts on its processes, and thus, we would like to highlight the following:

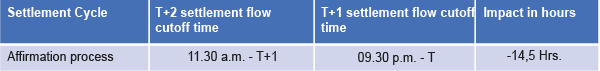

- As part of the settlement process of a transaction in the United States market, the affirmation process, up to now, a voluntary activity, becomes mandatory for the involved parties (investor/custodian and broker of the foreign counterpart), which involves several fewer hours for coordination before the settlement.

Affirmation is the confirmation of negotiation and settlement of all involved parties in the trade.

- DCV has delegated this activity to its foreign custodians accordingly.

- The affirmation process must occur on the negotiation's record date, which is in T, due to which the instructions to DCV must arrive before the established cutoff time. A document with the cutoff times is attached.

Cutoff times in all markets (Spanish only)

- From May 28 to June 3, 2024, the International Help Desk will provide operational support until 08:15 p.m. to assist depositors in the first days of this change.

- Those transactions instructed out of the cutoff time will be managed as such.

- The transactions not affirmed by our custodian because they were instructed out of the cutoff time will have an extra charge that will be transferred to depositors as a refund once our custodian transfers it to us (USD 0.5 per transaction.).

- The cost overrun will be applied to sales transactions against payment or free-of-payment deliveries corresponding to Delivery transactions that our custodian registers in DTC. Due to the above, we suggest prioritizing these transactions when instructing to DCV.

- DCV will instruct the transactions to the custodian to the extent that the funds (USD) have been received in the case of purchases and if there are enough holdings in the account in the case of sales.

- A NON-AFFIRMED transaction does not mean that it cannot be settled, but that according to the industry's analyses, those non-affirmed transactions have a greater potential risk of failure.

- The transactions settled through the FED (Central Bank of the United States) are not part of this regulatory requirement. Although they can be settled in T+1, they do not require the affirmation process.

- As per the transactions instructed to be settled in Euroclear, the change of cycle to T+1 impacts only those transactions that are instructed to be settled in the USA external market and not for internal or bridge transactions.

DCV will soon start the Swift messaging automation project with custodian Citibank for securities instructions to avoid the manual process in the instruction flow from DCVe to the custodian. This will improve the time it takes to deliver instructions to the custodian. The implementation of this project is expected for the end of 2024.

We invite our depositors to obtain information about this change and review the impacts that they will have on their internal processes and communication with their foreign counterparts. Timely management depends greatly on good communication and operational coordination between the parties involved.

May you have any questions, contact your business executive.

E-mail:

Kind regards,

DEPÓSITO CENTRAL DE VALORES S.A.,

DEPÓSITO DE VALORES

EN

EN  ES

ES