|

Since 2013, Depósito Central de Valores and Omgeo, subsidiary of DTCC (USA), has offered local brokers access to Omgeo Central Trade Manager (CTM), a solution that provides an automatic process of communication, comparison and confirmation of operations for the Chilean market, in order to reduce the risk of failure in the transaction and significantly improve the efficiency of operations.

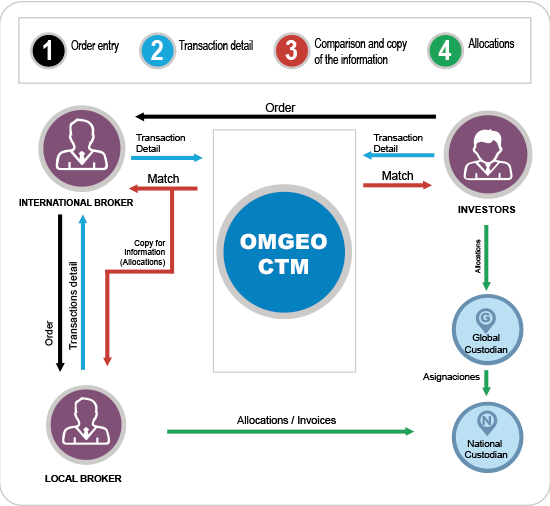

In the search to satisfy the particular needs of the Chilean market, DCV and Omgeo have developed a new functionality for the service. Copy For Information (CFI), not only allows stockbrokers to communicate with international investors, but also with other intermediaries, thus extending the scope of companies interacting through the platform.

In Chile, the negotiation flow for international transactions often involves the intervention of intermediaries (other international brokers) to reach final investors. We are certain that this new display opens a range of solutions for local brokers considering that their principal foreign counterparties are not only investors, but also foreign brokers.

In its original version, the Omgeo CTM service, did not allow for communication with other intermediaries. The great value of this new functionality is that it recognizes a particular need of the local market and responds to broker requirements for the improvement of their international processes.

Reporting the details of the transactions to then compare/confirm with their international counterparties presents great challenges without an established automatic process. In this scenario, the idea of seeking automation and improving the communication has become the center of attention throughout the financial sector in recent years. There is definitely great interest in adopting better practices based upon transparency and greater control in the tracking of transactions, where both parties (investors or brokers) validate and accept information related to the business and thus obtain the allocations and confirmation of their operations.

Efficiency in the comparison of transactions is an essential component to help reduce risk. The alliance between DCV and Omgeo allows Chilean market participants to use an international standard for the comparison process. Omgeo Central Trade Manager, in general, compares fixed income and equity securities, negotiable derivatives in the stock exchange and repo operations, for both local and international markets. The comparison process has also proven to further accelerate the entire post negotiation and pre-settlement stage, providing companies the possibility of achieving confirmations on the same day (or SDA), which greatly enables the efficiency of the settlement.

The standardization delivered by Omgeo Central Trade Manager significantly reduces the number of manual processes currently occurring in the middle office. The solution provides brokers the capability to improve the service and the communication with their counterparties (foreign brokers or final investors) as well as to expedite their own processes, reducing risks and costs. Whereas the Chilean broker in many cases acts as agent for the international broker, the Copy For Information (CFI) functionality eliminates a large obstacle, and local brokers receive the details of the transactions compared between the global broker and the investor automatically and in real-time.

Moreover, CTM can also be used in conjunction with Omgeo ALERT, which is a database for the maintenance and communication of settlement instructions.

Omgeo has years of experience and work together with market participants, regulators, technology suppliers, securities depositories, local infrastructure suppliers and industry entities in order to promote efficiency and standardization. Since the end of 2013, 1,700 clients are now using Omgeo CTM. Over 430 brokers and investment administrators joined the CTM community in 2013, which represents a 33% increase.

It is clear that more and more companies seek to implement good practices in post-trade operations and ensure that they are in the best position to support varied initiatives of the industry such as the shifting towards shorter settlement cycles. Market participants must now act to ensure that they can complete all the pre-settlement stages of the cycle, including the confirmation of the transaction in a timely and effective way.

DCV Noticias

|