Cross-border Custody and Settlement Services

We allow DCV participants who invest in securities abroad to hold custody of these investments in a manner similar to the custody of domestic securities through the DCV Evolution Platform (DCVe). We have entered into agreements with international securities depositories and global custodians, becoming part of a network of international custodians that allows us to keep instruments in custody abroad on behalf of our depositors. Likewise, we have agreements to open cash accounts to facilitate the settlement of transactions and the procedures associated with exercising economic rights.

Cross-border Custody and Settlement Services

SECTIONS

Proprietary Securities

Accounts used to record securities that belong directly to the account holder, who is the legal owner and ultimate beneficial owner of such assets.

Third-Party Securities

These are accounts that group multiple international securities belonging to third-party clients of the account holder. The end client is not identified in the DCV registry (although the intermediary does maintain this information internally).

Investor Securities

Accounts for the securities of specific investors who have formally delegated the management of their holdings to a financial intermediary or managing entity.

Cross-border Custody

A broad international network that allows you to safe keep your investments in foreign securities in almost all markets around the world.

Latin American Integrated Market (MILA)

Custody of securities from transactions carried out in the Latin American Integrated Market (MILA): Peru, Colombia, and Chile.

Foreign Securities Market

We offer custody of foreign securities registered in the Foreign Securities Registry of the CMF for transactions carried out in both the foreign and domestic markets through NUAM.

Against payment and free of payment

Foreign settlement instructions from depositors are executed against payment or free of payment.

Securities Depositary Network

We have entered into agreements with international central securities depositories and global custodians, creating an extensive custody network that provides access to nearly every country in the world.

Cross-border Custody

A broad international network that allows you to safe keep your investments in foreign securities in almost all markets around the world.

The service includes the custody of securities, transactions with securities in custody, and the administration of such securities.

Access to reports from the DCV Evolution (DCVe) platform.

• Holdings certificates.

•Querying transaction movements settled abroad.

•Querying balances abroad.

• Corporate action inquiries, announcements, and payments.

Depositors/DCV Participants

- Secure and efficient access to the custody of global market instruments.

- Simplification of the operational and administrative management of international securities.

- Transparency and trust in the custody of financial instruments issued abroad.

- Option to open one or more accounts in DCV, either its own or for third-party clients of the depositor. Annotation of the securities in the accounts that DCV has with the cross-border custodian, which are reflected in Chile in an account in the depositor’s name.

- Foreign securities will utilize the same infrastructure as domestic securities, allowing the depositor to access the same information as domestic securities.

Latin American Integrated Market (MILA)

Custody of securities from transactions carried out in the Latin American Integrated Market (MILA): Peru, Colombia, and Chile.

The service includes the custody of securities, transactions with securities in custody, and the administration of such securities.

Access to reports from the DCV Evolution (DCVe) platform.

• Holdings certificates.

• Querying transaction movements settled abroad.

• Querying balances abroad.

• Corporate action inquiries, announcements, and payments.

Depositors who are clients of the cross-border custody service.

- Secure and efficient access for the safekeeping of Latin American Integrated Market (MILA) instruments.

- Everything is in one place. Foreign securities will utilize the same infrastructure as domestic securities, allowing the depositor to access the same information as domestic securities.

Foreign Securities Market

We offer custody of foreign securities registered in the Foreign Securities Registry of the CMF for transactions carried out in both the foreign and domestic markets through NUAM.

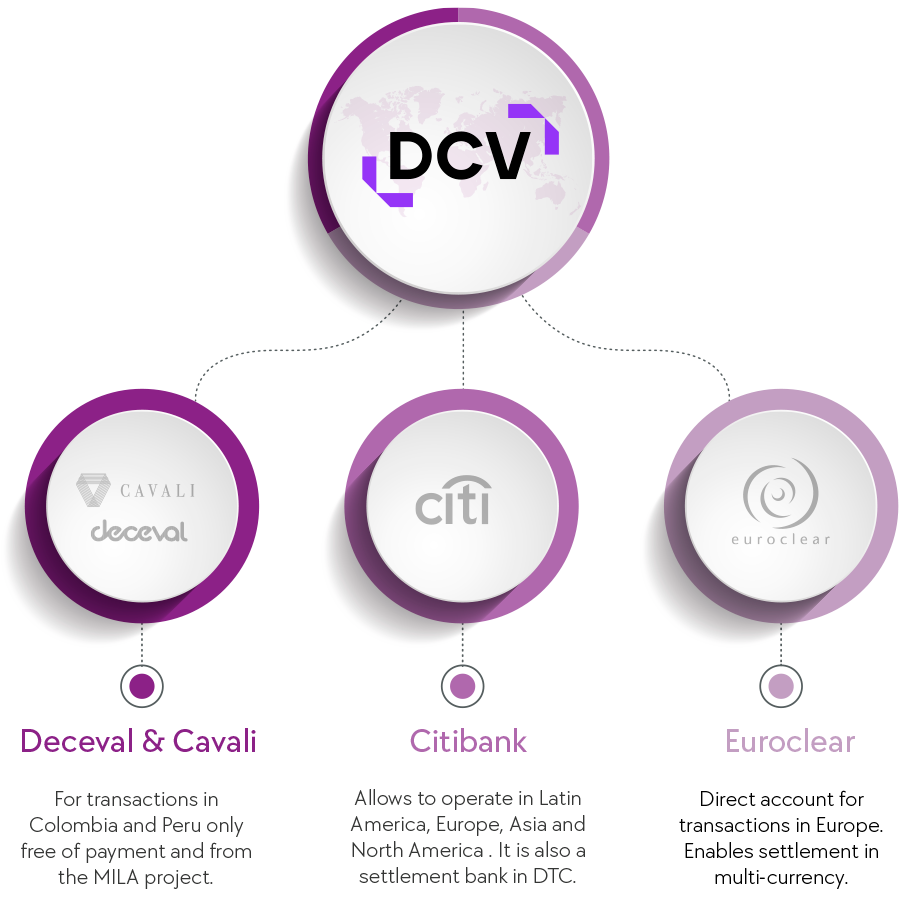

To offer this service, DCV has entered into agreements with the following custodians: Citibank, Euroclear, and DECEVAL (Colombia).

We provide centralized custody of domestic and foreign securities, as well as access to reports from the DCV Evolution (DCVe) platform.

• Holdings certificates.

• Querying transaction movements settled abroad.

• Querying balances abroad.

• Corporate action inquiries, announcements, and payments.

Depositors who are clients of the cross-border custody service.

- Secure and efficient access for the safekeeping of instruments.

- Custody platform that allows transactions in Chilean pesos (CLP) or US dollars (USD) for foreign securities registered in the domestic market, as stipulated by the sponsor for trading purposes.

- Everything is in one place. Foreign securities will utilize the same infrastructure as domestic securities, allowing the depositor to access the same information as domestic securities.

Proprietary Securities

Accounts used to record securities that belong directly to the account holder, who is the legal owner and ultimate beneficial owner of such assets.

Holding accounts are the virtual place where the electronic record of the balances of all transactions carried out with securities held on deposit are kept.

The cross-border custody service depositor operates these accounts on the DCV Evolution platform (DCVe), which adheres to the highest technological standards for managing balances and securities movements held on deposit.

These accounts, available to participants who sign up for the service, will record the depositor’s securities. Key characteristics include:

• They allow depositors to deposit and trade securities that they own.

• They only allow the crediting of current securities holdings.

• The beneficiary of the rights for the securities is the depositor.

Depositors who are clients of the cross-border custody service.

- Everything is in one place – in DCV Evolution, you can manage your domestic and cross-border securities accounts.

- Management and custody of proprietary international assets.

- Facilitates transactions, including trading, assignment, and reallocations, among others:

- Provides security and certainty regarding the ownership of securities.

Third-Party Securities

These are accounts that group multiple international securities belonging to third-party clients of the account holder. The end client is not identified in the DCV registry (although the intermediary does maintain this information internally).

Holding accounts are the virtual place where the electronic record of the balances of all transactions carried out with securities held on deposit are kept.

These accounts enable the collective management of assets in a foreign custodian on behalf of the client.

The accounts that depositors request to be opened in the name of their clients are managed by the depositors in DCVe. In turn, third-party accounts in foreign custodians are managed by DCV.

Depositors who are clients of the cross-border custody service.

- Collective, simple, and secure management of assets belonging to clients. It can be omnibus or segregated (investor).

- The institutions that hire the security custody services can offer this service to third parties by opening an omnibus securities account.

Investor Securities

Accounts for the securities of specific investors who have formally delegated the management of their holdings to a financial intermediary or managing entity.

Each investor has its own account in a foreign custodian, ensuring that the assets are completely separated from those of other investors or the intermediary.

The accounts that depositors request to be opened in the name of their clients are managed by the depositors in DCV Evolucion (DCVe). In turn, third-party accounts in foreign custodians are managed by DCV.

Depositors who are clients of the cross-border custody service.

- Customized asset management for investors.

- The securities holdings of each investor are identified in DCV, even if their management has been delegated.

- The investor can review its account movements and receive statements certified by DCV detailing the movements made by its securities administrator within a specified period.

Cross-border Custody

A broad international network that allows you to safe keep your investments in foreign securities in almost all markets around the world.

The service includes the custody of securities, transactions with securities in custody, and the administration of such securities.

Access to reports from the DCV Evolution (DCVe) platform.

• Holdings certificates.

•Querying transaction movements settled abroad.

•Querying balances abroad.

• Corporate action inquiries, announcements, and payments.

Depositors/DCV Participants

- Secure and efficient access to the custody of global market instruments.

- Simplification of the operational and administrative management of international securities.

- Transparency and trust in the custody of financial instruments issued abroad.

- Option to open one or more accounts in DCV, either its own or for third-party clients of the depositor. Annotation of the securities in the accounts that DCV has with the cross-border custodian, which are reflected in Chile in an account in the depositor’s name.

- Foreign securities will utilize the same infrastructure as domestic securities, allowing the depositor to access the same information as domestic securities.

Latin American Integrated Market (MILA)

Custody of securities from transactions carried out in the Latin American Integrated Market (MILA): Peru, Colombia, and Chile.

The service includes the custody of securities, transactions with securities in custody, and the administration of such securities.

Access to reports from the DCV Evolution (DCVe) platform.

• Holdings certificates.

• Querying transaction movements settled abroad.

• Querying balances abroad.

• Corporate action inquiries, announcements, and payments.

Depositors who are clients of the cross-border custody service.

- Secure and efficient access for the safekeeping of Latin American Integrated Market (MILA) instruments.

- Everything is in one place. Foreign securities will utilize the same infrastructure as domestic securities, allowing the depositor to access the same information as domestic securities.

Foreign Securities Market

We offer custody of foreign securities registered in the Foreign Securities Registry of the CMF for transactions carried out in both the foreign and domestic markets through NUAM.

To offer this service, DCV has entered into agreements with the following custodians: Citibank, Euroclear, and DECEVAL (Colombia).

We provide centralized custody of domestic and foreign securities, as well as access to reports from the DCV Evolution (DCVe) platform.

• Holdings certificates.

• Querying transaction movements settled abroad.

• Querying balances abroad.

• Corporate action inquiries, announcements, and payments.

Depositors who are clients of the cross-border custody service.

- Secure and efficient access for the safekeeping of instruments.

- Custody platform that allows transactions in Chilean pesos (CLP) or US dollars (USD) for foreign securities registered in the domestic market, as stipulated by the sponsor for trading purposes.

- Everything is in one place. Foreign securities will utilize the same infrastructure as domestic securities, allowing the depositor to access the same information as domestic securities.

Against payment and free of payment

Foreign settlement instructions from depositors are executed against payment or free of payment.

Our DCV Evolution platform facilitates the transfer of ownership of securities.

Record the traceability of trading transactions, ensuring delivery versus payment and thus eliminating counterparty risk.

Securities Depositary Network

We have entered into agreements with international central securities depositories and global custodians, creating an extensive custody network that provides access to nearly every country in the world.

Digital Financial Asset

Digital Financial Asset